In today’s fast-paced digital economy, businesses require secure, customizable, and scalable payment processing solutions. A white-label payment gateway allows businesses to rebrand an existing payment platform as their own, ensuring seamless transactions while maintaining brand identity. These solutions help companies reduce development costs, achieve PCI compliance, and provide a branded payment experience for their customers. This article explores seven leading white-label payment gateway providers, offering insights into their features, assets, and liabilities, helping you choose the best solution for your business.

Contents

- 1 What is a White Label Payment Gateway?

- 2 How Do White Label Payment Gateways Work?

- 3 Key Factors to Consider When Choosing a White Label Payment Gateway

- 4 Top 7 White Label Payment Gateway Solutions for Growing Businesses

- 4.1 1. Akurateco- Advanced Payment Orchestration Platform

- 4.2 2. Nuvei- Global Payment Processing Leader

- 4.3 3. Ikajo International-High-Risk Payment Specialist

- 4.4 4. Corefy – Centralized Payment Management

- 4.5 5. Cardstream- UK-Based Payment Gateway Provider

- 4.6 6. Payrix – Embedded Payment Infrastructure for SaaS

- 4.7 7. Tranzzo- Global Payment Processing with AI-Driven Security

- 5 Best Practices for Using a White-Label Payment Gateway

- 6 Steps for Choosing a White-Label Payment Gateway

- 7 FAQ

- 7.1 1. What is the main advantage of using a white-label payment gateway?

- 7.2 2. Are white-label payment gateways secure?

- 7.3 3. How does pricing work for white-label payment gateways?

- 7.4 4. Can I integrate a white-label payment gateway with my existing platform?

- 7.5 5. What industries benefit the most from white-label payment gateways?

- 8 Conclusion

What is a White Label Payment Gateway?

A white-label payment gateway is a customizable payment processing platform that businesses can rebrand as their own. This allows companies to offer seamless transactions without the need to develop their own payment infrastructure.

Key Benefits:

Faster Go-To-Market: This avoids the need to build a proprietary payment gateway from scratch.

Brand Consistency: Maintain a cohesive brand identity across all payment interactions.

Regulatory Compliance: Many white-label solutions come with built-in PCI compliance and fraud prevention measures.

Scalability: Ideal for businesses planning global expansion or high-volume transactions.

Revenue Opportunities: Businesses can monetize payments by charging fees or offering the gateway as a service.

How Do White Label Payment Gateways Work?

A white-label payment gateway functions by connecting multiple payment service providers (PSPs) to process transactions securely. The typical workflow involves:

- Customer Checkout: A customer selects their preferred payment method at checkout.

- Transaction Authorization: The payment gateway routes payment information to a payment processor.

- Fraud & Security Checks: Anti-fraud measures and encryption ensure secure transactions.

- Payment Settlement: The funds are processed and transferred to the merchant’s account.

Key Factors to Consider When Choosing a White Label Payment Gateway

Before selecting a white-label payment gateway, businesses should evaluate these crucial factors:

1. Integration & Compatibility

- API, SDK, and plugin support for seamless integration.

- Multi-currency support for international transactions.

- Accounting software & CRM compatibility.

2. Security & Compliance

- PCI DSS Level 1 compliance.

- Real-time fraud detection & risk assessment.

- Tokenization and encryption for secure data handling.

3. Scalability & Pricing Models

- Support for high-volume transactions.

- Flexible pricing models (per transaction, subscription, or revenue-sharing).

- Customization options for branding.

4. Customer Support & Onboarding

- Dedicated account managers & technical support.

- Comprehensive API documentation and testing environments.

- Merchant services onboarding support.

Top 7 White Label Payment Gateway Solutions for Growing Businesses

1. Akurateco- Advanced Payment Orchestration Platform

Akurateco provides an AI-driven payment orchestration platform that enables businesses to optimize transactions and improve payment routing. It offers customizable white-label payment solutions, multiple integration options, and strong fraud detection mechanisms.

Features

- Advanced payment orchestration for smart routing.

- Multi-currency support for international transactions.

- PCI-compliant with robust security features.

Assets

- Fraud detection and AI-driven risk management.

- Customizable checkout experiences.

- Global coverage with over 100+ payment methods.

Liabilities

- Complexity in setup for businesses without technical teams.

- Pricing may not be ideal for small-scale businesses.

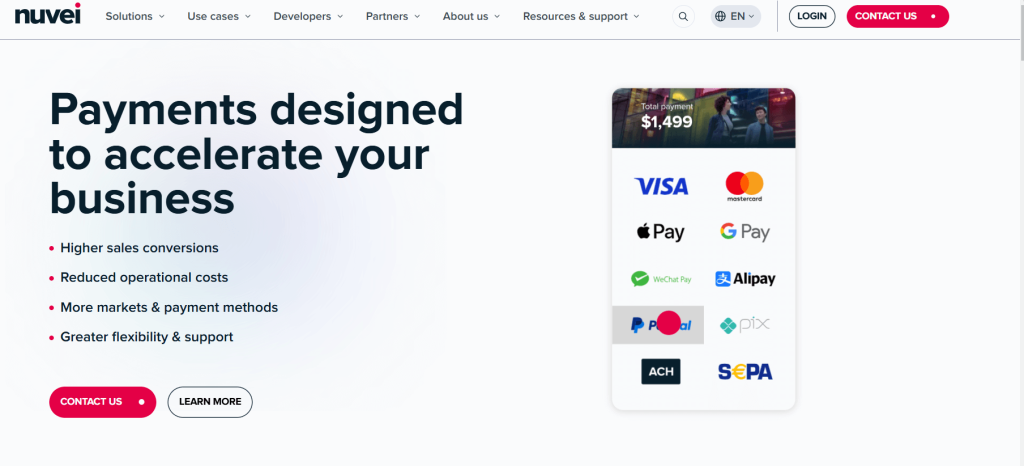

2. Nuvei- Global Payment Processing Leader

Nuvei specializes in global payment acceptance, providing businesses with seamless omnichannel payment solutions. Its white-label platform offers high scalability, custom-branded checkout experiences, and AI-powered fraud prevention.

Features

- Omnichannel payment processing for online and offline transactions.

- AI-driven fraud prevention tools.

- Custom-branded checkout with seamless UX.

Assets

- Supports global payment methods and digital wallets.

- High scalability for large enterprises.

- Transparent pricing models.

Liabilities

- Integration complexity for businesses without in-house developers.

- Additional fees for premium support.

3. Ikajo International-High-Risk Payment Specialist

Ikajo International is renowned for serving high-risk businesses. It offers multi-currency payment processing, fraud protection, and localized payment solutions, which makes it perfect for cross-border business.

Features

- Multi-currency support and localization for global payments.

- Cross-border payment processing with fraud prevention.

- White-label capabilities for merchant portals and dashboards.

Assets

- Trusted in high-risk industries.

- Supports diverse payment methods.

- Customizable fraud prevention rules.

Liabilities

- Higher transaction fees for high-risk merchants.

- Limited support for smaller businesses.

4. Corefy – Centralized Payment Management

Corefy is a payment orchestration platform that centralizes multiple payment providers into a single interface. It is designed for enterprises seeking advanced payment routing and multi-currency support.

Features

- Payment orchestration for intelligent transaction routing.

- Multiple payment service providers integration.

- Custom-branded reports and dashboards.

Assets

- Centralized payment data management.

- High scalability for enterprises.

- Extensive integration options.

Liabilities

- Initial setup complexity.

- Advanced modules may increase costs.

5. Cardstream- UK-Based Payment Gateway Provider

Cardstream is a UK-based independent white-label payment gateway that supports multiple acquirers and payment methods. It provides custom branding options and seamless API integrations.

Features

- Multi-acquirer connections for payment flexibility.

- Real-time transaction monitoring and analytics.

- White-label merchant onboarding support.

Assets

- Strong reputation in the UK and Europe.

- User-friendly back-office system.

- Multiple branding options.

Liabilities

- Longer onboarding for new acquirer connections.

- Limited global presence outside the UK and EU.

6. Payrix – Embedded Payment Infrastructure for SaaS

Payrix is a fully integrated payment solution designed for SaaS platforms. It enables businesses to embed payments directly into their software, making it a popular choice for subscription-based models.

Features

- Embedded finance options for SaaS businesses.

- Automated reconciliation and settlement.

- Custom checkout pages.

Assets

- Built for SaaS platforms.

- Revenue stream expansion via embedded payments.

- Advanced reporting and analytics.

Liabilities

- Not ideal for non-SaaS businesses.

- Premium features can be costly.

7. Tranzzo- Global Payment Processing with AI-Driven Security

Tranzzo offers a global payment processing platform with AI-powered fraud detection and multi-currency support. It is widely used by international businesses looking for a scalable white-label solution.

Features

- Multi-currency and multi-language checkout.

- Customizable risk management tools.

- Support for alternative payment methods (APMs).

Assets

- Flexible pricing for businesses of all sizes.

- Localized payment processing.

- Strong fraud protection mechanisms.

Liabilities

- Limited support in some regions.

- Feature-rich but may be overkill for small businesses.

Best Practices for Using a White-Label Payment Gateway

- Optimize the Payment Flow: Make sure the transaction is smooth to lower cart abandonment.

- Enhance Security Measures: Implement multi-layered security to protect payment data.

- Monitor Performance Regularly: Use analytics to track transactions, detect fraud, and improve user experience.

- Stay Compliant: Keep up with PCI DSS and other regulations to avoid legal complications.

- Offer Multiple Payment Methods: Appeal to a wider customer base by accepting credit cards, digital wallets, and bank transfers.

Steps for Choosing a White-Label Payment Gateway

- Assess Your Business Needs: Decide what functions are a necessity for your business.

- Compare Pricing Models: Look for a provider that offers transparent and cost-effective pricing.

- Check Integration Capabilities: Ensure that the gateway integrates smoothly with your existing platforms.

- Request a Demo: Test the platform before committing to a long-term contract.

- Evaluate Customer Support: Choose a provider that offers 24/7 support and dedicated account management.

FAQ

1. What is the main advantage of using a white-label payment gateway?

White-label payment gateways allow businesses to rebrand a payment solution as their own, providing a seamless and customized payment experience without the need for costly infrastructure development.

2. Are white-label payment gateways secure?

Yes, most reputable white-label payment gateways comply with PCI DSS security standards and incorporate encryption and fraud prevention tools to protect transaction data.

3. How does pricing work for white-label payment gateways?

Pricing models vary but typically include transaction fees, subscription plans, and revenue-sharing models. Some providers also offer custom pricing based on business size and volume.

4. Can I integrate a white-label payment gateway with my existing platform?

Yes, most white-label payment gateways offer API, SDK, and plugin integration options, making it easy to incorporate into existing business systems like eCommerce platforms, CRMs, and accounting software.

5. What industries benefit the most from white-label payment gateways?

White-label payment gateways are ideal for e-commerce, SaaS businesses, fintech startups, and financial service providers looking to manage payments under their own brand.

Conclusion

A white-label payment gateway enables businesses to enhance their payment experience, boost brand credibility, and expand globally. When selecting a provider, consider factors like security, compliance, integration ease, and pricing. If you’re a growing business, solutions like Akurateco, Nuvei, and Payrix offer scalability and robust security. Corefy and Ikajo International are excellent choices for those seeking customized branding and cross-border payments.

By choosing the right white-label payment gateway, businesses can streamline transactions, reduce operational costs, and increase revenue streams, making it a smart investment for long-term growth.