Managing projects effectively is critical for SaaS businesses with customizable dashboards for tracking payment information. But what happens when you add the complexity of financial workflows like invoicing, payment collection, and tracking expenses? That’s where these platforms with integrated payment gateways step in, simplifying your operations while saving time and effort in tracking gateway data.

These tools simplify collaboration and payments for CEOs and managers of SaaS businesses. They will help keep operations free of manual errors using effective invoice management. Whether automating client invoices or syncing payment statuses with tasks, these platforms are game-changers for freelancers managing their payment options.

In this guide, we’ll introduce seven standout project management tools that sync seamlessly with popular payment processors. By the end, you’ll have a clearer idea of which option fits your business needs, whether you’re a freelancer handling your own billing or a larger SaaS team looking to simplify complex workflows.

Contents

- 1 What Are Project Management Platforms with Payment Gateway Integrations?

- 2 Why Should One Use Project Management Tools with Payment Gateways?

- 3 7 Reasons to Choose Tools with Payment Gateway Integration

- 4 Top 7 Project Management Platforms That Integrate Seamlessly with Payment Gateways

- 5 Conclusion

- 6 Subscribe to Technicali.com for in-depth SaaS tool reviews, actionable insights, and expert strategies to optimize your workflows

- 7 You have Successfully Subscribed!

What Are Project Management Platforms with Payment Gateway Integrations?

These software tools help businesses organize, collaborate, and execute them efficiently. These platforms provide features like task assignment, progress tracking, and real-time collaboration.

When these platforms integrate with payment gateways, they unlock additional functionalities such as:

- Automating client invoicing.

- Tracking payment statuses within project dashboards enhances the visibility of payment transactions.

- Enhancing financial transparency across teams.

Why It Matters for SaaS Businesses

It solves this central pain point: managing tasks and payment in distinct systems.

Benefits include:

- Streamlined operations: Eliminate manual data transfer between project and financial tools.

- Real-Time Insights: Monitor progress alongside payment statuses.

- Secure Transactions: Ensure payments are processed through PCI DSS-compliant gateways.

Ready to simplify your workflows? Read on to discover the best tools for your business!

Why Should One Use Project Management Tools with Payment Gateways?

The Business Advantage

Combining this business with payment gateway integrations delivers several critical advantages for SaaS businesses:

- Operational Efficiency: Manage payments gateway from a single dashboard, reducing errors.

- Customer Satisfaction: Provide clients with a seamless invoicing and payment experience.

- Enhanced Security: Keep financial transactions secure with encrypted payment information.

Adopting these tools isn’t just convenient for fast-growing SaaS businesses – it’s necessary for scaling efficiently.

7 Reasons to Choose Tools with Payment Gateway Integration

1. Workflow Automation

Automation is the basis of invoicing, reminding for payments, and status tracking through the connection of payment gateways, which frees your team from strategic work.

2. Centralized Data Management

Having all updates regarding payments and gateway integration in one place prevents information silos and ensures everyone has access to real-time data.

3. Time-Saving

Say goodbye to redundant data entry. These tools automatically sync payments and task updates, saving manual process time.

4. Secure Payment Processing

Top tools ensure payments are processed securely and comply with international standards like PCI DSS, making them reliable payment processors.

5. Financial Transparency

Track expenses, invoices, and payment statuses directly within the dashboards for clear, actionable insights.

6. Improved Collaboration

Teams can work on projects and handle financial updates simultaneously, ensuring smoother communication.

7. Scalability

These tools grow with your business, offering advanced plans to accommodate more users and financial workflows.

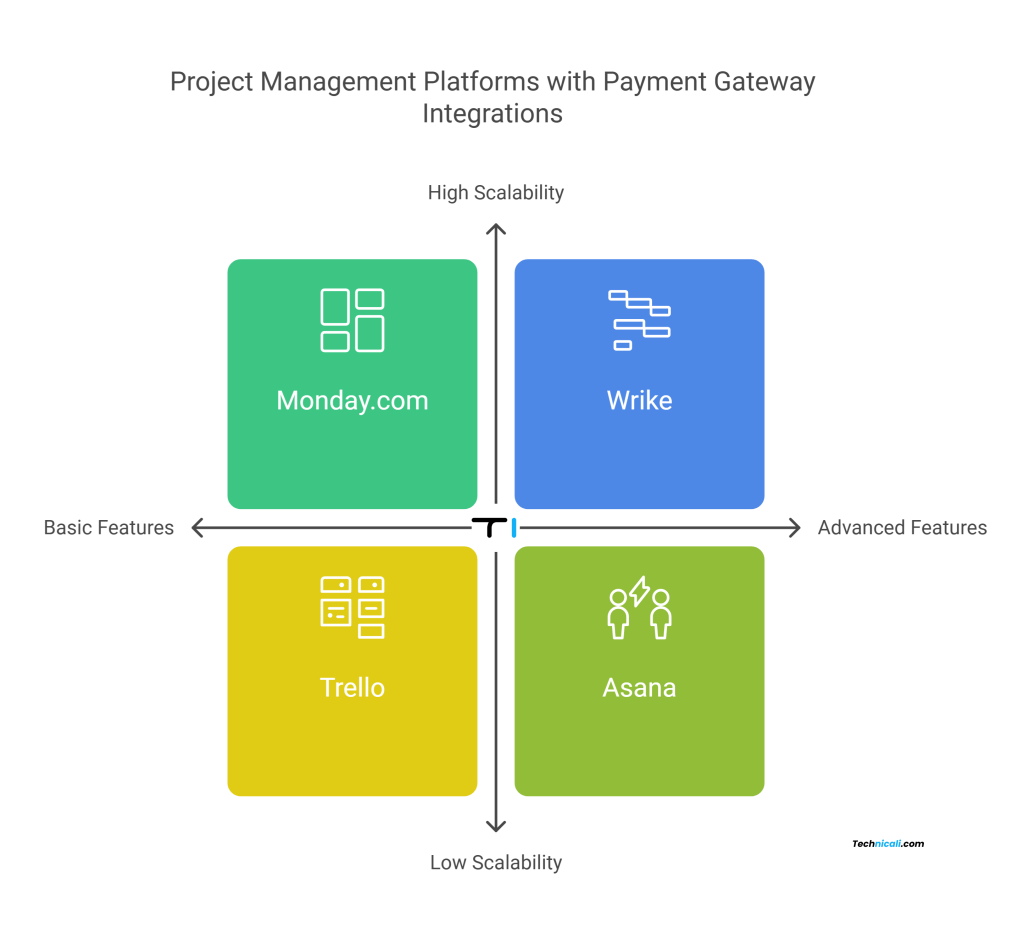

Top 7 Project Management Platforms That Integrate Seamlessly with Payment Gateways

1. Monday.com

Monday.com is an incredibly versatile tool for businesses that combines project tracking with effective workflow management of clients and numerous payment options. The platform integrates with gateways such as Stripe and PayPal to make sure teams can easily handle the invoicing and payments that accompany the tasks.

Top 5 Features of Monday.com

- Customizable Dashboards: Boards to monitor tasks, payment options, deadlines, and status payments simultaneously can be tailored.

- Automation: Set triggers for overdue payments or invoice approvals to Save time by optimizing your payment processing infrastructure.

- Integration Capabilities: Connect with Stripe, PayPal, and QuickBooks for seamless financial operations.

- Collaborative Tools: Share tool updates and financial reports in real time.

- Scalability: Designed for startups and enterprises, offering advanced plans for growing teams.

Assets

- It is easy to use and visually intuitive, supporting project management integration with financial tools and various payment options.

- Strong automation Monday.com features a variety of integration services for payment handling.

- Seamlessly integrates with many payment gateways to enhance operational efficiency.

- Suitable for businesses of all sizes looking for a great partnership with customers.

- Excellent customer support.

Liabilities

- The learning curve for advanced Monday.com features a variety of integration services for payment handling.

- Higher-tier plans are needed for robust payment integrations.

- It can feel overwhelming for smaller teams to manage their project cost.

How It Differs

Monday.com offers unmatched customization of payment workflows, with an added payments gateway, unlike the more straightforward tools like Trello.

2. Asana

Asana is a leader in easy-to-use task management, with robust features for managing project expenses. Partnering with leading payment gateways like QuickBooks(with Make) and Stripe(direct) makes this an increasingly popular option among SaaS companies looking to simplify financial workflows.

In fact, according to the Asana “Anatomy of Work Global Index 2023,” workers spend about 58% of their time on work coordination rather than the skilled work they were hired to do (Source: Asana). When you integrate payment gateways directly into your project management platform, you help streamline these processes, reduce manual errors, and free your team to focus on high-impact work. The result? More efficient, transparent operations and a smoother path to growth.

Asana provides highly customized project boards on which team members can work to manage projects, track progress, and handle payments from one single place. Whether managing a single project or working with many teams, Asana’s flexibility dominates all operations.

Top 5 Features of Asana

- Task Automation: Automate invoice approvals, payment follow-ups, and task assignments, reducing manual errors and saving time.

- Custom Fields: Include fields for tracking payment statuses, invoice numbers, and due dates in task boards.

- Payment Gateway Integrations: Integrate with tools such as QuickBooks, Stripe, and Xero for automatic invoicing and tracking payments.

- Templates for Finance Projects: Pre-built templates simplify setting up recurring financial workflows, such as monthly invoicing or expense approvals.

- Real-Time Collaboration: Keep teams updated on their progress and financial statuses with real-time notifications and updates.

Assets

- Simple and intuitive interface for new users.

- Affordable pricing plans for small to medium businesses.

- Extensive library of integrations for diverse needs.

- Great for remote teams with its real-time collaboration features.

- Excellent mobile app for on-the-go management of payment data.

Liabilities

- Compared to advanced tools like Asana, limited automation offers an easy integration process for various financial tools, including a secure payment gateway that supports multiple payment options. Allows project managers to oversee payment workflows seamlessly.

- Reporting capabilities require higher-tier plans.

- It can feel limited for huge teams or enterprises.

- The product has no native invoicing system; it depends on other integrations with third-party payment gateways for external payment processing.

- Some users mention that task boards for projects with a bigger contextual setup can be messy.

How It Differs

While Monday.com has much more automation with financial workflows, Asana is great for small teams that just want to streamline payments and tasks with its simplicity and affordability.

3. Wrike

Wrike is an advanced management platform made for scaling businesses that have serious needs for advanced collaboration and financial workflow features. Seamless payment gateway integrations are a part of Wrike; hence, teams can monitor payments, create invoices, and track tasks without having to leave their platform, thus integrating much more smoothly. So far as dynamic dashboards and detailed reporting tools are concerned. Wrike provides pretty smart integrations used by complex software businesses. It makes financial tracking simple.

Top 5 Features of Wrike

- Dynamic Dashboards: Monitor payment statuses, timelines, and resource allocations from one customizable dashboard.

- Invoice Tracking: The tools allow you to track corporate payments.

- Third-Party Integrations: It integrates with Stripe, Square, Xero, and other payment tools to ensure smooth financial workflows

- Advanced Reporting Tools: Generate financial reports alongside tools progress to provide a holistic view of business operations and ensure compliance with payment card industry data security standards.

- Cross-Team Collaboration: Share real-time payment details, financial updates, and milestones with teams and clients through effective API integration and customer management.

Assets

- Excellent scalability for medium to large teams is a key feature of effective management software.

- Advanced analytics tools are essential for understanding the impact of payment systems on business performance.

- Highly customizable dashboards for detailed financial tracking.

- Strong third-party integration capabilities.

- Effective for cross-department collaboration.

Liabilities

- Higher cost for premium features.

- The complex interface can overwhelm new users.

- Limited offline functionality.

- It requires significant setup time for advanced workflows involving the payment gateway.

- Certain integrations need extra settings, or it integrates easily with third-party payment gateways like Zapier.

How It Differs

Wrike, on the other hand, offers enhanced reporting capabilities when necessary, along with dynamic dashboards, making it ideal for larger teams focused on more valuable products compared to the basic tools.

4. Trello

Trello is a lightweight, card-based software management tool known for its simplicity and ease of use. Although less feature-rich than a few of its competitors, the payment gateway integrations with PayPal and Stripe emake it an unexpectedly sound choice for small businesses looking to track payments in tandem with tasks.

Trello uses a visual interface that makes organizing tools, assigning tasks, and monitoring financial updates easy. This makes Trello suitable for teams that are either starting out or handling straightforward workflows.

Top 5 Features of Trello

- Visual Card-Based Layout: Organize tasks, payments, and deadlines on customizable hosted payment pageable boards.

- Power-Ups: Integrations for payment gateways like Stripe, QuickBooks, and PayPal can add functionality.

- Checklists and Attachments: Put payment details, invoices, recurring payments, and financial documents in task cards.

- Collaboration Tools: Share boards with team members, clients, or stakeholders for transparency in your project management system.

- Free Plan: Trello’s free plan supports unlimited boards, making it accessible for small teams.

Assets

- Highly user-friendly and beginner-friendly.

- Free plan suitable for small teams.

- Integrates well with a variety of tools.

- A highly visual and intuitive layout enhances the integration method for hosted payment pages.

- Mobile-friendly design for managing tasks on the go.

Liabilities

- Limited scalability for larger businesses.

- Basic reporting features.

- Advanced functionality relies on third-party Power-Ups and often integrates with online payment gateways.

- It lacks built-in financial tracking tools, making using a custom payment gateway essential.

- It is not ideal for complex project management workflows.

How It Differs

Trello’s simplicity and free plan make it an excellent choice for small teams, unlike advanced platforms like Wrike that cater to larger organizations.

5. Smartsheet

Smartsheet is a versatile management software that blends the familiarity of spreadsheets with the power of advanced collaboration and automation features. It’s an excellent choice for SaaS businesses managing software that requires detailed financial tracking and payment workflows.

With seamless integrations for payment gateways like Stripe and PayPal, Having integrated well with Zapier for payment gateways like Stripe and PayPal, Smartsheet enables teams to handle invoicing and tracking of expenses and monitors payment statuses along with their work in the task progress category.

Top 5 Features of Smartsheet

- Grid-Based Interface: Smartsheet features a spreadsheet-like layout for managing and tracking tasks, invoices, and finances. For any kind of payment, accessibility to financial data is an essential factor.

- Automation Workflows: Automate payment reminders, invoice approvals, and recurring financial updates.

- Payment Gateway Integrations: Connects with Stripe, PayPal, and QuickBooks for streamlined payment processing on the hosted pages.

- Collaboration Tools: Share sheets with teams and stakeholders for real-time tools and payment updates.

- Advanced Reporting: Generate detailed reports on expenses, payment statuses, and financials.

Assets

- Highly customizable for unique workflows, allowing fraud detection and prevention tools to be integrated.

- Perfect for businesses familiar with spreadsheets and looking to improve their payment flow.

- Scalable for this with financial complexities, especially when using a reliable payment gateway provider.

- Intense automation and integration capabilities.

- Effective for managing multi-team collaborations.

Liabilities

- The steep learning curve for new users.

- Premium features are locked behind higher pricing tiers.

- Lacks the native mobile application experience as slick as its competition.

- It can be too complicated for small, simple management tools.

- There are a few advanced templates for financial tracking.

How It Differs

Its grid-based approach makes it more suitable for businesses that transition from traditional spreadsheets and move into a more collaborative, automated tool, unlike the easier alternatives like Trello.

6. ClickUp

ClickUp is an all-in-one project management software platform with full tool and budget management capabilities, including features for invoice handling. Or maximum customization and versatility. Payment gateway such as Stripe and QuickBooks with Jotform interation allow SaaS companies to perform tasks, follow payments, and analyze financial data with ease.

ClickUp is for organizations of any size, offering scalability with advanced automation and reporting features to ease complex workflows.

Top 5 Features of ClickUp

- Customizable Dashboards: Create custom dashboards that show payments, task completion rates, and KPIs.

- Payment Integrations: Sync with Stripe, Xero, and QuickBooks for seamless financial workflows, including invoicing and payment tracking.

- Task and Time Tracking: Monitor billable hours and generate invoices directly from time-tracked tasks.

- Automation: Create workflows to automatically send payment reminders, update status, and notify team members of financial changes that can be easily managed by integrating the right payment gateway.

- Real-Time Collaboration: Collaborate with team members using shared task boards, comments, and financial updates in real-time.

Assets

- Extremely versatile and highly customizable.

- Affordable plans with advanced features for freelancers and project managers.

- Combines these management, financial tracking, and time tracking in one platform, streamlining budget management.

- Great for teams handling complex workflows with a focus on payment solutions.

- Regular updates and feature additions.

Liabilities

- Intensive for newcomers because of its high feature concentration

- Intermittent issues with the release of new features.

- Needs time to establish sophisticated automation and integration systems.

- Certain integrations rely on external tools such as Zapier.

- Restricted offline capabilities.

How It Differs

ClickUp’s ability to track time and generate invoices directly from tasks makes it a standout choice for businesses that rely on billable hours, offering a unique advantage over tools like Smartsheet.

Check Out Full Review of ClickUp Here.

7. Jira

Jira, developed by Atlassian, provides a powerful gateway management API designed for agile teams. Though primarily centered on software development, Jira’s wide range of integrations with payment processors and financial management tools boosts its capabilities. Tools create a strong solution for handling their online payment processing. Payments within SaaS companies.

Jira excels at handling complex workflows, offering unparalleled customization, detailed reporting, and the ability to scale for enterprise needs.

Top 5 Features of Jira

- Agile Workflow Support: Manage these features using Kanban, Scrum, or custom workflows, making it ideal for iterative gateway.

- Payment Gateway Integrations: With API and Excel sheets Sync with tools like Stripe, QuickBooks, and Xero to track payment statuses and automate invoicing through your preferred payment method.

- Automation Rules: Automatically generate invoices or send payment reminders when these milestones are reached.

- Customizable Dashboards: Monitor real-time financial data, its progress, and team performance.

- Marketplace Add-Ons: Access thousands of integrations and add-ons, including payment tracking tools and online payment methods, to extend Jira’s capabilities.

Assets

- Designed for agile workflows, it is ideal for development teams and their managers, especially when integrating project management tools.

- Extensive customization options.

- Advanced reporting and analytics tools.

- Scalable for businesses of all sizes.

- Thousands of add-ons for extended functionality.

Liabilities

- Not beginner-friendly; requires onboarding and training.

- Advanced features can be costly for smaller teams needing robust customer management.

- Heavily focused on software development, which might not suit all use cases, especially regarding payment integration.

- Complex setup for financial workflows involving payment solutions.

- Limited financial tracking capabilities without integrations into your payment systems.

How It Differs

This gives Jira a focus on agile practices and a whole suite of add-ons that can be used, making it the go-to for development teams, which tools like Trello or Asana do not offer.

Conclusion

Integrating payment workflows into these management tools is a strategic move for SaaS businesses to enhance productivity, security, and efficiency. Each platform – the simplicity of Trello, the versatility of ClickUp, or the agile focus of Jira – offers unique advantages tailored to specific business needs.

Whether you’re a startup needing basic functionality or a scaling enterprise requiring advanced customization, there’s a solution for you in this list. Start by exploring free trials and matching features with your business goals to find the perfect platform.