Contents

- 1 Introduction to Virtual Terminal Payment Gateways

- 2 Understanding Payment Terminals and Virtual Terminal Basics

- 3 The Role of Virtual Terminal in Field Service Businesses

- 4 Step-by-Step Guide to Using a Virtual Terminal

- 5 Top Benefits of a Virtual Terminal Solution

- 6 Choosing the Best Virtual Terminal Provider

- 7 Practical Tips & Best Practices

- 8 Conclusion & Call to Action

- 9 Optional FAQs & Future Outlook

Introduction to Virtual Terminal Payment Gateways

Definition & Importance

In an era where payment technologies evolve at lightning speed, many organizations seek a terminal solution flexible enough to meet onsite and remote demands. A virtual terminal emerges as a web-based application that helps field service providers streamline payment operations without needing a physical card reader or cumbersome POS hardware.

Field service industries; ranging from home repair companies to onsite maintenance teams – often deal with card-not-present scenarios. By harnessing keyed-in transactions through a virtual terminal, these businesses can accept payments anywhere, whether it’s over the phone or during onsite visits. Furthermore, integrating PCI and P2PE ensures that compliance remains intact, protecting the service provider and the customer from fraud or data breaches.

Meanwhile, SaaS (Software as a Service) models have amplified the ease of adopting virtual solutions, making it more straightforward for field service organizations to manage billing, track recurring payments, and maintain an efficient flow of payment data. The latest research in the industry shows more than 73% of the field service workers reported plans for upgrading payment technologies within a year. Therefore, there’s much value in investigating a virtual terminal solution if competition in such an increasingly fast-moving marketplace has any meaning to that organization.

Understanding Payment Terminals and Virtual Terminal Basics

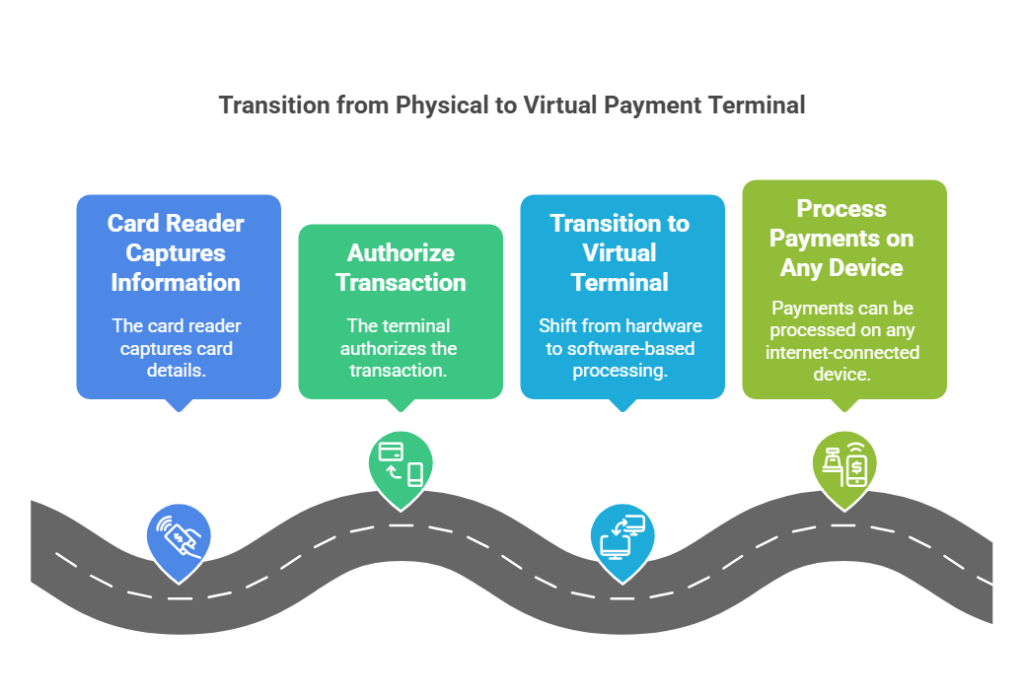

What Is a Payment Terminal?

A payment terminal traditionally refers to a physical device used to read credit and debit cards, often involving a card reader. This credit card terminal captures card information and authorizes the transaction. However, when transitioning to a virtual credit card terminal, you eliminate the bulky hardware requirement and gain the agility to process payments on any device with an internet connection.

In the field service context, technicians often deal with card-not-present situations. By adopting a virtual system, service providers can pivot away from the constraints of a physical credit card terminal. This shift not only reduces upfront hardware or software investments but also expands how, when, and where payment can be captured.

What Makes a Terminal “Virtual”?

A virtual terminal is a web-based application that allows for manual data entry of credit or debit card information. Since this terminal is a web-based application, the only need is an internet connection – no specialized hardware is necessary. More importantly, virtual terminals require robust security measures to guarantee secure payment processes.

By using a virtual terminal, field service personnel can key in customer information directly through a web browser, thus completing the transaction almost instantly. The best part? This approach eliminates the need for a physical card, saving money on processing costs and reducing friction during on-the-go services.

How Does a Virtual Terminal Work?

Wondering about the mechanics of virtual terminal work? Let’s break it down:

- Application That Allows Keyed-in Transactions

- A virtual terminal allows you to input your credit card number and other payment details manually. This detail is transmitted via secure channels, often with encryption protocols such as P2PE in place.

- Security Standards and Merchant Account

- Once the data is entered, it’s securely sent to a virtual terminal provider or payment processor, often requiring a merchant account to finalize the transaction. During this phase, advanced encryption ensures the highest security measures.

- Authorization and Settlement

The provider checks for compliance with PCI security standards, approves the transaction, and eventually deposits the funds into the merchant’s account. That’s how businesses that use a virtual terminal solution keep the workflow smooth while adhering to necessary guidelines.

The Role of Virtual Terminal in Field Service Businesses

Why Field Services Benefit from Virtual Terminal

Field service providers often operate in diverse environments; rooftops, lawns, customer living rooms-and require agile payment options. A virtual terminal meets that need:

- No need for a physical credit card terminal: Everything is done through an internet-connected device.

- Payments in the field: Technicians can capture payment on a smartphone or tablet, leading to faster transaction completion and improved cash flow.

- Card-not-present convenience: Over-the-phone payment or even via mail becomes a breeze.

- Additionally, recurring payments are more straightforward to handle with a virtual setup, letting companies store authorized billing agreements to reduce friction for future services.

Common Use Cases

- Onsite Billing: A plumber or HVAC technician finishes a job and immediately processes the invoice by using virtual tools to key in card details.

- Over-the-Phone Transactions: For customers calling in repairs, service reps can process payments over the phone by inputting their credit or debit card information into the virtual terminal.

- Subscriptions & Service Contracts: Securely manage recurring payments for monthly or annual maintenance programs without physically swiping a card.

Manual Entry Payment Compliance & Security

Manual entry payment compliance is essential. With p2pe, advanced encryption scrambles card information from the moment of entry until approval, protecting sensitive payment data from malicious actors. This approach aligns with PCI guidelines, ensuring security standards are consistently met, and your business can securely handle sensitive payment information.

Step-by-Step Guide to Using a Virtual Terminal

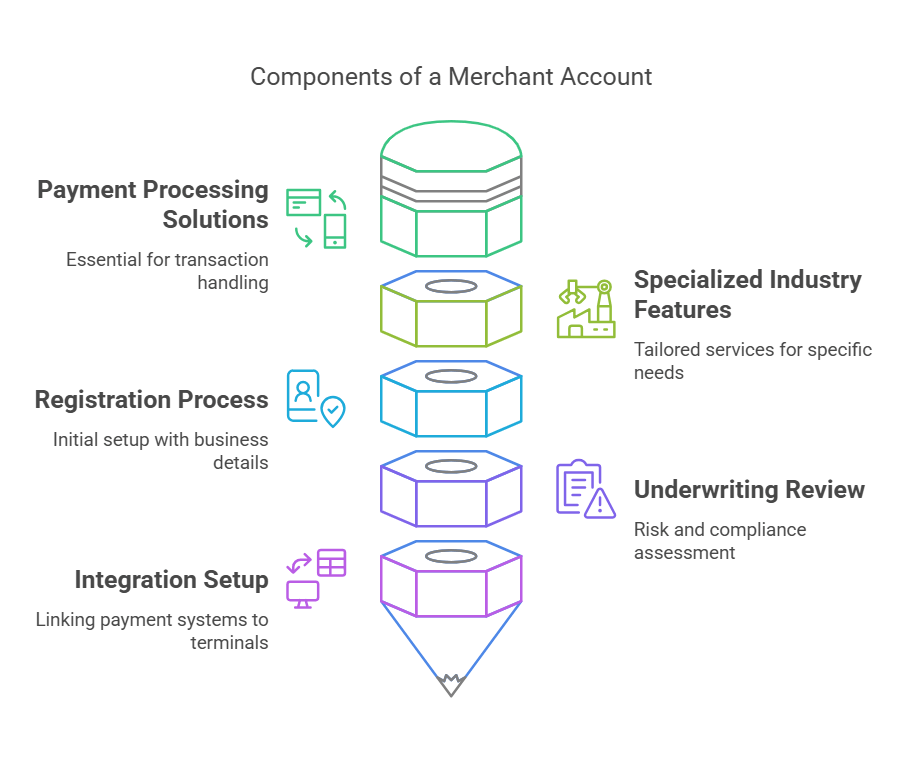

Setting Up a Merchant Account

Before you dive into using virtual terminals, you’ll typically need a merchant account from merchant account providers – these providers may offer everything from payment processing solutions to specialized industry features. Here’s what to expect:

- Registration: Provide the necessary business and banking details.

- Underwriting: The provider reviews your application, focusing on risk levels and compliance history.

- Integration: Once approved, you can link your chosen payment gateway or processor to your virtual terminal dashboard.

Using Virtual Terminals for Keyed-In Transactions

Using a virtual terminal for keyed-in transactions is straightforward:

- Open the Web-Based Dashboard: On any device with an internet connection, log in to your virtual terminal.

- Enter Payment Information: Key in the credit card number, expiration date, and other relevant payment details.

- Confirm and Process: Click “Submit,” the system will process a payment almost instantly, verifying funds before sending an approval notice.

Accepting Payments Over the Phone or Via Mail

Customers may prefer to share their card information over the phone or via mail, and a virtual payment system can accommodate these preferences easily:

- Phone or via mail orders are entered into the virtual terminal just as you would an in-person transaction.

- Real-time validation ensures the credit card payments go through promptly, fostering customer trust and satisfaction.

Mobile Virtual Terminal Payment

When mobile usage is critical, the best virtual solutions allow technicians to accept payments in the field. A smartphone or tablet running a virtual interface lets your team:

- Initiate Transactions: They can process payments the moment a service is complete.

- Send Digital Receipts: Offer paperless receipts via email.

- Reduce Delays: Expedite the overall billing cycle.

Top Benefits of a Virtual Terminal Solution

Reduced Operational Costs & Faster Cash Flow

A virtual terminal slashes hardware expenses since there’s no physical pos or traditional credit card device required. By allowing field agents to accept credit transactions directly, businesses can shorten payment collection cycles and improve overall billing efficiency.

Enhanced Security & Encryption

Since virtual terminals offer p2pe protection and enforce PCI compliance, organizations can securely handle card details without fear of data breaches. This heightened security fosters trust and encourages repeat business.

Scalability for SaaS & Field Services

Benefit from virtual terminal adaptability: whether you’re a small startup or a rapidly expanding enterprise, virtual systems integrate with SaaS platforms effortlessly. This synergy allows businesses to process payments at scale without investing in additional hardware.

Flexibility & Convenience

- Multiple Payment Methods: From credit and debit cards to online payment options, a virtual terminal can accommodate diverse payment methods.

- No Physical Constraints: All you really need is an internet connection, making the solution accessible worldwide.

- Real-Time Approvals: Because the system is web-based, transaction authorizations happen nearly instantly.

Choosing the Best Virtual Terminal Provider

Key Features to Look For

When selecting a virtual terminal provider, consider:

- Processing Fees: Evaluate the total cost, including gateway or monthly charges.

- Reliability: How consistently does the system stay online?

- Payment Processor Integration: Look for a seamless connection to your payment processor or existing solutions.

Security & Compliance Considerations

Confirm that your prospective partner adheres to PCI and p2pe requirements. Also, verify they have robust security measures like tokenization and data encryption to protect your payment card transactions from potential threats.

Integration with Payment Gateway & Other Payment Solutions

For synergy, choose a virtual terminal as part of a broader suite. This ensures minimal friction when adding new features such as recurring payments or when scaling your payment processing capabilities.

Notable Examples in the Market

- Clover Virtual Terminal: Known for its user-friendly interface and quick setup, it’s a strong competitor in the space.

- Other Market Leaders: Offer advanced features, such as advanced data insights, but weigh the cost-benefit ratio based on your specific field service requirements.

Practical Tips & Best Practices

Securely Storing Customer Information (When Allowed)

Data privacy is paramount. If you choose to store customer information, ensure you follow security standards:

- Limit who can access card information.

- Use only reputable providers who comply with PCI guidelines.

Optimizing Your Field Service Workflow

- Incorporate Virtual Payment Links into Invoices: This allows quicker closures on service orders.

- Train Technicians: Show them how to securely handle card-not-present transactions and confirm each transaction meticulously.

Tracking and Analyzing Payment Data

- Employ web-based analytics tools to monitor revenue patterns and discover bottlenecks.

- Periodically review your processor statements to identify if processing fees are still competitive.

Conclusion & Call to Action

A virtual terminal elevates field service operations by centralizing payment flows, enabling the process of payments anywhere, and strictly enforcing compliance. It merges the best of digital convenience and robust security to create an ecosystem where every transaction runs smoothly.

Optional FAQs & Future Outlook

Frequently Asked Questions (FAQ)

- Can a Virtual Terminal Handle Recurring Payments?

Absolutely. Many virtual terminals require minimal setup for subscription billing, providing a reliable foundation for recurring payments.

- Do I Need Special Hardware?

Typically no. Any device with an internet connection; laptop, tablet, or phone-can serve as your terminal to accept payments.

- How Are Transactions Secured?

Through encryption, tokenization, and vigilant security standards that align with PCI protocols. This helps ensure each transaction is protected from end to end.

Troubleshooting & Support

- Common Issues with Manual Entry

- Typos in the credit card number or expired credit or debit card information can trigger a declined transaction. Double-check each data field for accuracy.

- Working with a Virtual Terminal Provider

- Pick a provider that offers 24/7 support. Also, ensure their application that allows easy data entry has minimal downtime, as uninterrupted service fosters trust and reliability.

Future Outlook on Payment Technology

- AI and Automation

- Upcoming tools may detect fraudulent patterns during payment card transactions, further reducing chargebacks and disputes.

- Expanding Payment Methods

- As digital wallets and other emerging channels gain traction, field service providers should be ready to integrate these seamlessly into their payment processing solutions, staying ahead in a competitive landscape.