Contents

- 0.1 What is Payment Gateway in a Nutshell?

- 0.2 Payment Gateway Testing

- 0.3 Terminologies Associated With Payment Gateway

- 0.4 Transaction Process

- 0.5 Types of Payment Gateway Testing

- 0.6 Importance of Payment Gateway Testing

- 0.7 Scenarios to Test Your Payment Gateway

- 0.8 Checklist for Testing Payment Gateway

- 0.9 Aspects to Consider While Buying Payment Gateway

- 0.10 Payment Gateway Testing Precautions

- 1 Conclusion

What is Payment Gateway in a Nutshell?

Due to the heavy use of the internet and mobile phones, more and more customers prefer to shop online. The payment gateway validates the card details and makes funds available to make instant payments. Due to the rising popularity of online purchases, brick-and-mortar stores have also started electronic payment options for customers.

Payments using debit cards, credit cards, electronic transfer, e-cheques have become increasingly popular with the rise in the consumer’s internet spendings. The need for a safe and secured payment network to make payments have increased the interest and excitement about payment gateways.

The payment gateway is a merchant service provider that assists the merchant in accepting payments via debit cards, credit cards, or any other electronic medium. The introduction of the payment gateway was mainly to aid online stores and websites to accept payments virtually. The customers making online payments use the payment gateway to ensure secure and speedy payments for the goods or services bought online.

Types of Payment Gateways

| Hosted payment gateways | Self-hosted payment gateways |

| API hosted payment gateways | Local bank integrations |

Learn More about Payment Gateway/Processors.

Advantages of Using Payment Gateways

Some advantages of integrating payment gateways are :

- Global Reach

A payment gateway helps to accept and make payments from anywhere in the world and various currencies. It opens new doors for merchants looking to expand their business. It also benefits the customer to have an abundance of purchase choices and different payment options without the hassle of standing in the long checking-out queues.

- Cost Reduction

The automated process of the payment system makes it cost-efficient as compared to the traditional store option. It also saves the transport cost of traveling to the store location. The per-cost transaction of making payments on the payment gateway is also very low. Other than the set-up cost of the payment gateway, there are no additional hidden costs associated. In the traditional set-up, along with the set-up cost, you have to employ people and also bear the payment slip’s costs.

- Convenience and Comfort of the Customer

The long torment of waiting to make your payments after standing in a long queue is now a myth. The payment gateway makes the customer’s journey of online shopping more convenient and comfortable. You can make instant payments in the safety and comfort of your home. Payment gateway optimizes the entire process of making purchases and helps attain optimum customer satisfaction.

- Accepting Different Payment Options

Unlike the traditional store where cash was the driving source of making payments, payment gateways offer and accept various payment options. Credit cards, debit cards, e-cheques, EFT, direct bank transfers are some payment options provided by payment gateways. Some upcoming payment trends such as UPI, crypto payments, e-wallets, mobile payments are also supported in payment gateways.

- Reduces Errors

The payment gateways automate the entire process of the payment. The automated process reduces the need for human intervention, further decreasing the chances of human errors. The gateway easily integrates with the shopping cart of the website. It reduces the chances of error in the calculation of the total amount of purchase.

Functions of Payment Gateway

- Transaction Approval

The most significant role of the payment gateway is to approve the transaction between the merchant and customer. It authorises online payments and allows easy payments.

- Payment Ease

Making payments using the payment gateway allows the customer to use multiple payment options in one platform. Use different payment options without any hassle and make payments for the purchases.

- Authorization

The payment gateway acts as a middle man between the merchant and customer. It is responsible for authorizing the payment transaction and verifying the details given by the customer.

- Transfer of Funds

The payment gateway acts as an agent that transfers the transaction amount in the merchant’s account. Without the approval of the payment gateway, you will not receive the funds you are to receive.

- Security

Security is the most vital aspect of a payment gateway. The customer’s sensitive and private information is shared with the payment processor. The payment gateway has the role of encrypting the customer data before its transmission. It is also responsible for protecting the customer data from data leaks or other third-party invasions.

- Records

Payment gateway reports every transaction done with its processor. It also reports every success and failed transaction to both the customer and the merchant. These records and reports further help in bookkeeping and accounting.

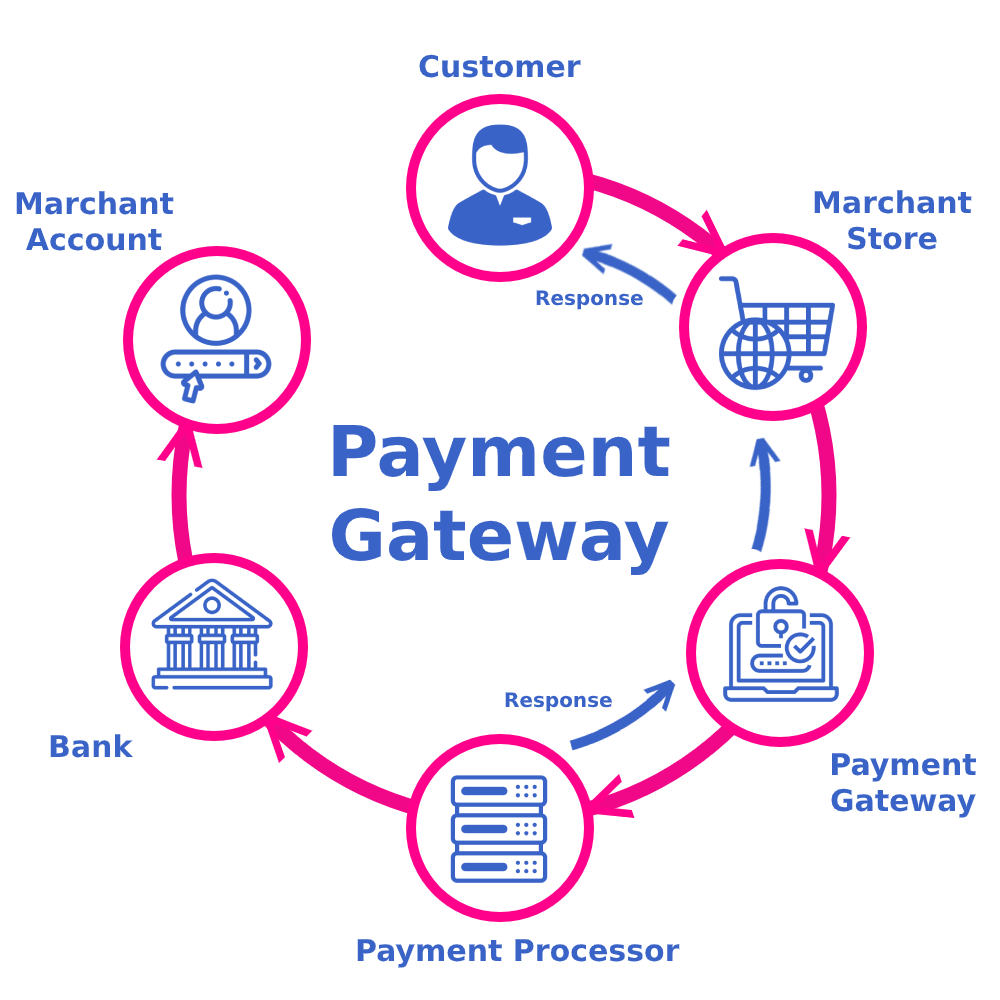

Payment Gateway Working

Let’s study the working of the payment gateway and understand the steps involved in making the payment.

- First, the customer places the order by pressing on pay now or the submit button.

- Then, the customer is directed to the payment gateway. Here, the customer fills in all the payment details like card details, bank details, etc. The payment gateway encrypts the customer data and further transfers it to the issuing bank.

- The issuing bank verifies the authenticity of the card and cardholder by sending it to the card-issuing company. The card issuing companies (Visa, MasterCard, etc.) send a response code to the payment gateway after the card’s verification.

- The response code is either approval or denial. In approval’s case, the positive response code is sent to the customer authorizing the payment. The merchant’s bank does the collection of money from the issuing bank.

- When the authorization is received from the bank, and the amount gets deducted, it is transferred to the merchant account through Payment Gateway.

- Suppose there is any hindrance or failure of the authorization from the bank. In that case, an error message is sent to the customer, whereas if the payments get approved, the customer will receive an email of the successful transaction and order being placed. The response code also shows the reason for the failure, for example, insufficient funds, expired card, etc.

Payment Gateway Testing

Today, the number of people using online payments is growing due to the steady growth in the internet infrastructure. The increased spending on online purchases calls for a sturdy and secured payment mechanism. Therefore, the requirement of testing the payment gateways to ensure encrypted channels that securely authorize and approve the transfer of funds is necessary.

E-commerce platforms must have a user-friendly and secured payment gateway that could handle the load without making a dent in the performance. The failure and glitches in loading the payments can cause serious harm to the company’s goodwill and decreasing customer loyalty. Hence, the business must seamlessly integrate e-commerce platforms and payment gateways to provide customers with a smooth user experience.

Payment gateway testing is a system in which users can test their payment gateway for online transactions and purchases. This testing helps to establish the security, performance, accuracy, and reliability of the payment gateway. Payment gateway testing aids in encrypting sensitive payment details from ill-intended third parties and provides secured transactions of funds between the merchant and the user.

Payment testing plays a vital role in the implementation, modernization, and working of payment gateways. It provides a pathway for various transaction channels such as debit cards, credit cards, and net banking to securely transfer funds to the merchant’s bank. Some of the famous payment gateways are PayPal, Citrus, Bluepay, SecurePay, Braintree, and Stripe.

Terminologies Associated With Payment Gateway

There are some terms associated with payment gateway testing that help us in better understanding the transaction flow. They are as follow:

- Merchant

Traditionally, a merchant is a person, company, or organization offering products and services to the customer. But today, the merchant also sells software and services at a website. Merchant is entitled and authorized to receive payments from the cardholders who are making online purchases. Examples of merchants are Amazon, Flipkart, Uber, Ebay, etc.

- Transaction Channel

A transaction can be processed through various mediums like a credit card, debit card, or electronic transfer. The credit card requires the user to have a credit account to make the purchase. It also contains a 16 digit card number, expiry date, magnetic stripe, CVV (credit verification value) number, and signature.

The debit card directly deducts the amount from the user’s account. It has a card number, valid from date, expiry date, EMV (Europay, Mastercard, and Visa) chip, and sort code. Electronic transfer simply means transferring funds from one account to another without any bank officials’ intervention with the internet.

- Acquiring Bank

A financial structure that enables the merchant to accept payments made by the customers through various channels on their website is called Acquiring bank. It maintains the merchant’s bank accounts and keeps their records.

- Issuing Bank

The issuing bank is responsible for issuing the customer’s debit or credit card on behalf of the card network. It is responsible for approving or declining the transaction based on the cardholder’s accounts status. If the amount of purchase is more than the credit limit, then the transaction is declined. Likewise, if the CVV number is wrong, the transaction is rejected.

- Transaction

Payment Gateway provides transaction payment by exchanging information and funds between the merchant and consumer.

- Authorization

Authorization is the process by which the identity and authenticity of the cardholder are ascertained. It confirms the identity and validity of the cardholder, availability of funds, and ability to pay. Authorization is requested while a customer purchases. After authorization, the funds are removed from the customer’s account but are not yet transferred to the merchant’s bank account.

- Capture

The funds on hold in the authorization process are transferred to the merchant’s bank when the transaction is captured. Capture is where the merchant obtains funds from the customer’s bank and further requests settlement to the processor.

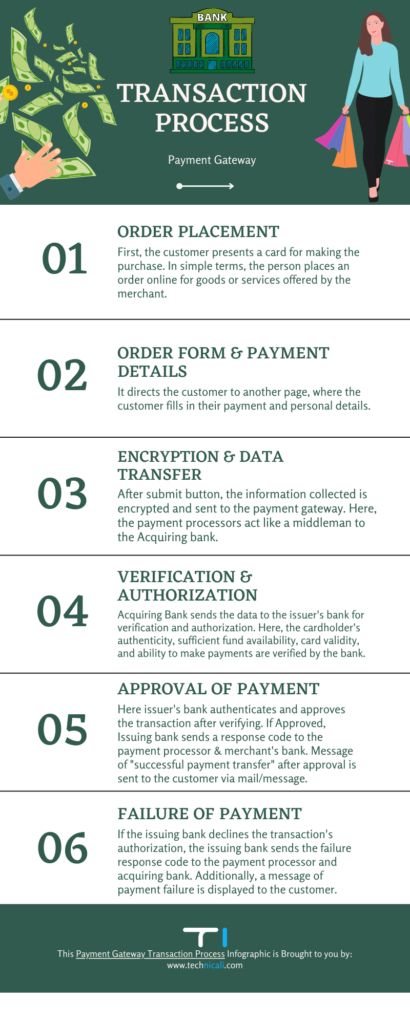

Transaction Process

Step1: Order Placement

First, the customer presents a card for making the purchase. In simple terms, the person places an order online for goods or services offered by the merchant.

Step2: Order Form and Payment Details

The web page directs the customer to another page, where the customer is asked to fill in their payment and personal details. It is like an order form that asks for personal information such as the name of the customer, address, email, mobile number, and payment details such as card number, expiry date, CVV number, etc.

Step3: Encryption and Data Transfer

After the customer clicks the submit or pay now button, the information collected is encrypted and sent to the payment gateway. Here, the payment processors act like a middleman and further transfer the encrypted data to the Acquiring bank.

Step4: Verification and Authorization

The acquiring bank sends the data to the issuer’s bank for verification and authorization. Here, the cardholder’s authenticity, sufficient fund availability, card validity, and ability to make payments are verified by the bank.

Step5: Approval of Payment

The issuer’s bank authenticates and approves the transaction after verifying the required information. If the transaction is approved, the issuing bank sends a response code to the payment processor and merchant’s bank. The message of successful payment transfer after approval is sent to the customer via mail or message.

Step6: Failure of Payment

If the issuing bank declines the transaction’s authorization, the issuing bank sends the failure response code to the payment processor and acquiring bank. Additionally, a message of payment failure is displayed to the customer.

Note:

If the customer wishes to cancel the order, he sends the cancellation request to the payment processor. If the payment is made, the processor requests a refund. In the case where payment is not made, the transaction is not completed and is declared void.

Types of Payment Gateway Testing

- Functional Testing

Relatively newly-established payment gateways use functional testing. It ensures that the application is working as it is supposed to be. Base functions such as tackling payment orders, making order calculations, tax and VAT calculations are done here. These base functionality of payment gateways are tested to assure uninterrupted working of the payment gateway. Established payment gateways such as PayPal can avoid this testing as it is not required.

- Integration Testing

As the name suggests, integration testing is used when the merchant is looking to integrate a payment gateway with the website. It verifies the smooth working of the payment gateway and online store or website application of the merchant. The entire flow of transactions is tested here. From the order placement till the recovery of funds in the merchant’s bank are tested. It additionally verifies the cancellation transaction that includes refunds and void transactions.

- Performance Testing

Performance testing tests the security, speed, reliability, and performance of a payment gateway. It tests the sturdiness of the gateway to function while there are multiple users making transactions efficiently. The testing is done to ensure that the payment gateway is working smoothly at the load time and across the different environments. It also evaluates memory storage, network capacity, and space for the accurate functioning of the server.

- Security Testing

While making payment, the customer provides his personal information to the gateway. The sensitive information includes the cardholder’s account number, CVV number, card number, personal address, email, mobile numbers. It is vital to ensure the privacy and security of the sensitive data the customer gives. The security testing ensures the gateway is safe from spoofing, data manipulation, and scripting. It verifies the encryption of information channel networks that connect bank servers from cyber-attacks and other vulnerabilities.

Importance of Payment Gateway Testing

Payment gateway testing helps the merchant to ensure that the customers can actually make payments on their website. It also evaluates the security parameters of the consumer data that is vulnerable to outside third parties.

Data glitches and outside interference of ill-intended third parties can cause serious harm to customers as they share their financial details. Stealing the data can also harm the integrity and customer loyalty of the business.

Testing the payment gateway also keeps you informed about the various components and tools working and areas that need improvement. Ensuring the customer’s comfort while making the payments and satisfying the customer are the core elements to test the gateway.

To inspect, check, and reduce the technical issues faced by the customer to make payments. Testing payment gateway enhances the speed, accuracy, and security of your payment processor. It integrates the customer’s purchase journey by providing a smooth and fast payment experience.

Scenarios to Test Your Payment Gateway

Some of the examples mentioned below can help verify the authenticity and smooth working of the payment gateways.

- Changing the language of the payment gateway while making a transaction.

- Check if the funds are transferred to the merchant’s account after successful payment.

- Look at the number of buffer pages between the web page and payment gateway.

- Checking the pop-up block settings and observing the changes when the pop-up blocking is on and off.

- Inspecting the error pages that occur when making a payment and examining its security.

- Trying and checking the authenticity of each payment option and its different currency formats.

- Ensuring the details of credit cards or debit cards are stored in the database entries securely.

- Check all the components and tools of payment gateways to verify their respective working.

- Check if the message is delivered to the customer to inform them about the transaction’s acceptance or failure.

- After the successful payment in the payment gateway, ensure that it returns to your website or application.

- Goods should not be shipped until the confirmation slip that authorizes the transaction payment is received.

- Check if the email and message sent by the payment gateway are encrypting the content.

- Check the response time of the payment gateway to process a payment.

- Inspect what happens if the transaction or payment is not completed.

Checklist for Testing Payment Gateway

- Collect data for credit card dummies from different card providers.

- Collect information regarding payment wallets, PayPal, and other related information.

- Document error codes documentation for future reference.

- Test all the functions and tools of the payment thoroughly to ensure smooth payment.

- Make sure the messages and pop-ups are working fine when making payments.

- Check and apply different language options in the payment gateway.

- Check the security and measures used to prevent fraud in the payment gateway.

- Ensure proper integration of your website and payment gateway.

Aspects to Consider While Buying Payment Gateway

- Check the compatibility of your payment gateway and website or application. Ensure harmonious relations between them.

- Look at the list of applications and tools supported by the payment gateway before buying the package.

- Enquire about the transaction fee charged per transaction by the payment gateway.

- Check the availability of various payment options and verify the acceptance of all payment types (debit card, credit card, electronic transfer, cryptocurrency payment, etc.)

- Check if there are redirections to a different page while making payments or on the website form.

- Enquire about the security and address verification protection system while buying the payment gateway.

- Ensure the efficiency of your transaction and choose a payment gateway that makes quick payments with ease.

- Choose a payment gateway having a 24×7 hours support system to guide you in case of any problems.

Payment Gateway Testing Precautions

- Consider the time required while redirecting to a different page.

- Reduce the buffer time needed while making payments.

- Ensure the format and delivery of each successful or failed transaction to the respective customer.

- Keep a strict eye on the customer’s sensitive data and ensure its security.

- Set a payment sandbox if possible to gain flexibility and customization of tools in the payment gateway.

- Test end-to-end transactions to ensure proper data flow and capture a variety of bugs in the transaction.

- Configure different sandboxes to research the limitation and test the system behavior from various aspects.

- Verify the security of the channel used in payment gateways. Example HTTP or HTTPS.

- Check if the refund or void amount matches the actual amount of the transaction.

Conclusion

Payment gateway is the pillar of the e-commerce platform. We need to understand the working and structure of the payment gateway. It is a link that bridges the gap between the merchant and the customer. The trend of payment gateways is rapidly acquiring popularity and approval in the world. The need for increasing awareness and validating more information regarding the payment gateway is arising. As more and more payment gateways are entering the market, the merchant should thoroughly test them before purchasing.

Payment gateway testing helps to increase the trustworthiness and reliability of payment. It is essential to test each component of the payment processor to ensure no future difficulties in payments. If not tested properly, it can damage the goodwill of the business and decline sales. Merchants are required to plan different scenarios and test the payment gateway. Payment gateway testing would ensure a sturdy payment processor that will optimize the user experience and increase customer satisfaction.