Contents

- 1 Why the Best Credit Card Reader Matters for Your Small Business

- 2 Key Factors in Choosing a Credit Card Reader for Your Business

- 3 Best credit card readers for small businesses

- 3.1 1. Clover Compact: Streamlined System for Small Businesses

- 3.2 Key Features

- 3.3 Pros

- 3.4 Cons

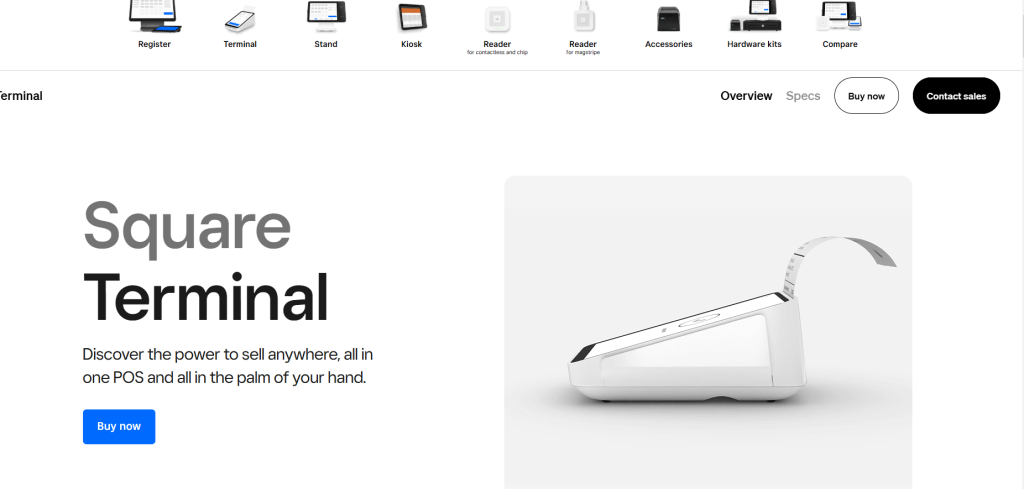

- 3.5 2. Square Terminal: All-in-One Card Machine for Small Businesses

- 3.6 Key Features

- 3.7 Pros

- 3.8 Cons

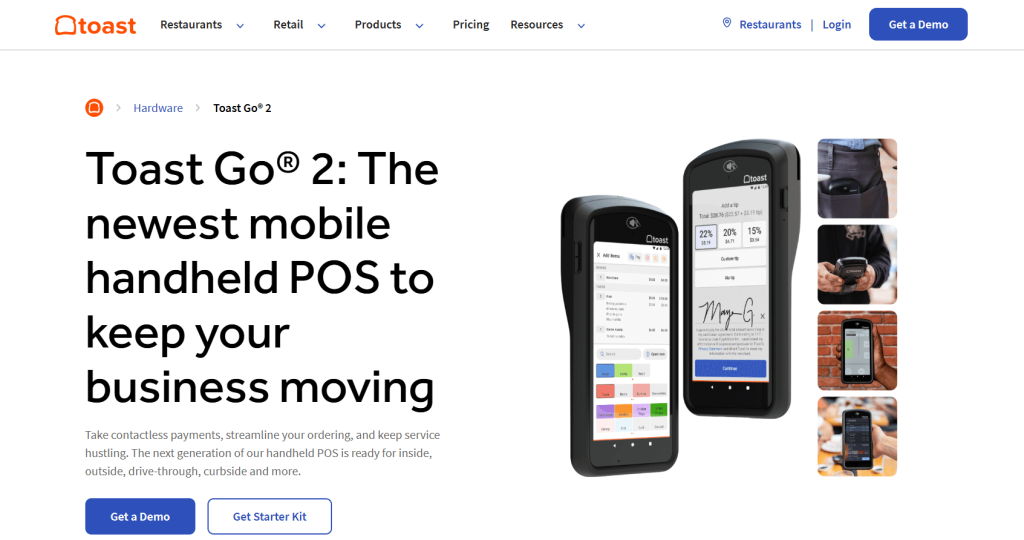

- 3.9 3. Toast Go: Tailored for Restaurants and Food Services

- 3.10 Key Features

- 3.11 Pros

- 3.12 Cons

- 3.13 4. SwipeSimple B250: Lightweight, Mobile-Centric Reader

- 3.14 Cons

- 3.15 5. Dejavoo (via Payment Depot): Transparent Pricing with Modern Terminals

- 3.16 Key Features

- 3.17 Pros

- 3.18 Cons

- 3.19 6. Leaders Merchant Services (Clover Reseller): One-Stop Payment Solution

- 3.20 Key Features

- 3.21 Pros

- 3.22 Cons

- 3.23 7. Stax: Subscription-Based Card Processing Model

- 3.24 Key Features

- 3.25 Pros

- 3.26 Cons

- 4 How to Integrate Your New Credit Card Reader Into Your Existing System

- 5 Comparing Credit Card Readers for Small Business: Quick Reference Table

- 6 FAQs About Credit Card Processing & Card Reader Solutions

- 7 Conclusion: Elevate Your Small Business With the Best Credit Card Reader

Why the Best Credit Card Reader Matters for Your Small Business

In today’s rapidly evolving marketplace, small businesses must adapt to the increasing preference for cashless transactions. The number of credit cards in circulation rose to 543.1 million in Q1 2024, up from 523.2 million in Q1 2023. This shift underscores the importance of equipping your business with reliable credit card readers.

Key Benefits

- Enhanced Customer Experience: Providing multiple payment methods, such as mobile and contactless payments, accommodates customer choice and can result in higher sales.

- Improved Security: Modern credit card readers, including those with contactless capabilities, come equipped with advanced security features, reducing the risk of fraudulent activities.

- Operational Efficiency: Integrating card readers with your point-of-sale systems streamlines transactions, reducing wait times and improving overall service quality.

Key Factors in Choosing a Credit Card Reader for Your Business

Selecting the right credit card reader involves evaluating several critical aspects:

1. Payment Processing Fees

Understanding the costs associated with card transactions is vital.

- Interchange Fees: These are fees set by card networks like Visa and Mastercard, typically comprising a percentage of the transaction plus a fixed amount.

- Subscription Models: Some providers offer flat-rate monthly fees, which can be cost-effective for businesses with high transaction volumes.

2. Payment Card Types & Compatibility

Make sure the reader accommodates multiple payment options, such as credit card payments.

- EMV Chip Cards: EMV Chip Cards are widely adopted for their enhanced security features.

- Contactless Payments: Facilitates quick transactions via NFC technology.

- Mobile Wallets: Compatibility with services like Apple Pay and Google Wallet caters to tech-savvy customers.

3. Integration & POS Systems

Seamless integration with your existing systems is crucial.

- Software Compatibility: The reader should work harmoniously with your current POS software or accounting systems.

- Mobile Applications: The availability of dedicated apps can enhance functionality and ease of use.

4. Security & Fraud Protection

Customer data protection earns trust and protects your business.

- Encryption Standards: Ensure devices provide end-to-end encryption.

- PCI-DSS Compliance: Ensures the reader meets industry-standard security requirements.

5. Device Usability & Support

Consider the practical aspects of daily use.

- Design and Portability: Mobile card readers are a step ahead in convenience. Depending on your business model, you may require a stationary terminal or a portable device.

- Customer Support: Access to good support can quickly resolve issues, saving time.

Best credit card readers for small businesses

1. Clover Compact: Streamlined System for Small Businesses

The Clover Compact is a sleek, all-in-one countertop solution designed to handle high-volume transactions efficiently. Its compact design saves space without compromising functionality, making it ideal for bustling small business environments.

Key Features

- Integrated Hardware: Includes a built-in receipt printer and barcode scanner.

- Versatile Payment Acceptance: Supports EMV chip, magstripe, and contactless payments.

- App Marketplace: Accept credit card payments easily through various integrated solutions. Access to a variety of apps to customize and enhance business operations.

- Real-Time Reporting: Provides up-to-date sales data that is accessible from any device.

- Employee Management: Features tools for tracking employee performance and managing permissions for business owners.

Pros

- Comprehensive Functionality: Integrates many features into a single device to minimize the amount of extra gear needed.

- User-Friendly Interface: Intuitive design simplifies training and daily operations.

- Scalable Solutions: Comes with multiple plans and add-ons to scale along with your company’s needs.

Cons

- Cost Considerations: Higher upfront investment compared to basic card readers.

- Potential Overhead: Some features may require additional fees or subscriptions.

2. Square Terminal: All-in-One Card Machine for Small Businesses

The Square Terminal is a portable, all-in-one card machine that enables businesses to accept payments and print receipts seamlessly. Its compact design and wireless capabilities make it suitable for both countertop and mobile use.

Key Features

- Comprehensive Payment Acceptance: This includes support for various credit card payment types. Handles chip cards, contactless payments, and mobile wallets.

- Built-In Receipt Printer: Reduces the requirement for extra peripherals.

- Offline Mode: Allows transactions even without an internet connection, syncing once reconnected.

- Transparent Pricing: Flat-rate transaction fees with no hidden charges, making it easier for business owners to manage their finances.

- Seamless Integration: Works effortlessly with other Square products and services.

Pros

- Mobility: Wireless design supports payments anywhere within your business premises.

- Ease of Use: A square register simplifies transactions with its user-friendly design. A simple setup process with an intuitive touchscreen interface makes it easy to use the helm card reader.

- No Long-Term Contracts: Flexibility without binding agreements.

Cons

- Limited Customization: This may not offer the same level of personalization as some competitors in terms of card reader providers.

- Transaction Fees: While transparent, fees may be higher for businesses with large transaction volumes when using certain credit card payment types.

3. Toast Go: Tailored for Restaurants and Food Services

Toast Go is a handheld credit card reader, similar to the Square Reader, for contactless transactions. Specifically designed for restaurants, cafés, and bars. It allows servers to take orders and process payments tableside, reducing wait times and improving the overall dining experience. Toast Go integrates with the Toast POS ecosystem, offering a seamless end-to-end solution for food service businesses.

Key Features

- Contactless, Chip, and Magstripe Payments: Supports all major card payment types, including Apple Pay and Google Pay.

- Tableside Ordering & Payments: Enhances efficiency by allowing orders and payments to be processed in one step.

- Cloud-Based Synchronization: Updates sales, inventory, and menu changes in real time.

- Durable, Spill-Resistant Build: Designed for high-paced food service environments.

- Integrated Tipping & Loyalty Features: Encourages tipping and repeat business through built-in customer engagement tools.

Pros

- Reduces order processing time and enhances table turnover rates.

- Minimizes payment errors by allowing direct server input.

- Integrates with kitchen display systems for seamless communication.

Cons

- Monthly subscription fees can be costly for small establishments.

- Only compatible with Toast POS, not ideal for businesses using other POS systems.

4. SwipeSimple B250: Lightweight, Mobile-Centric Reader

SwipeSimple B250 is an ultra-portable mobile credit card reader that connects via Bluetooth to smartphones and tablets. Ideal for small businesses, freelancers, and on-the-go service providers, it allows seamless card transactions without requiring a full POS setup.

Key Features

- Bluetooth Connectivity: Works with iOS and Android devices via the SwipeSimple app.

- EMV Chip, Magstripe, and Contactless Payments: Accepts credit and debit card transactions securely.

- Low-Cost Hardware: Affordable for small businesses with no hidden monthly fees.

- Battery-Powered & Wireless: Provides true mobility for vendors, event-based sellers, and field service professionals.

- Real-Time Reporting & Sales Insights: Offers a cloud-based dashboard for transaction monitoring.

Pros

- Compact and lightweight for easy mobility.

- Competitive transaction fees with flexible pricing models.

- Strong security features, including encryption and PCI compliance.

Cons

- Lacks advanced POS features that are often found in modern credit card terminals. Found in countertop models that include a chip reader.

- Requires a smartphone or tablet for operation.

5. Dejavoo (via Payment Depot): Transparent Pricing with Modern Terminals

Dejavoo, in partnership with Payment Depot, offers a range of modern payment terminals with a membership-style pricing model. This is an excellent option for businesses looking for wholesale interchange rates instead of traditional percentage-based transaction fees.

Key Features

- Supports EMV, NFC, and Magstripe Payments: Ensures secure transactions with contactless and chip-enabled capabilities.

- Membership-Based Pricing: Reduces costs for businesses processing high transaction volumes.

- Cloud-Based Merchant Dashboard: Provides real-time insights and analytics.

- WiFi and Cellular Connectivity: Works in-store or on the go.

- Seamless POS Integration: Compatible with many major POS software solutions, including those that support chip and magstripe card transactions.

Pros

- Potential for lower transaction costs due to wholesale rates.

- Multiple terminal options for different business needs.

- Robust security features to protect credit card information.

Cons

- It is not ideal for small businesses with low transaction volumes.

- Requires a Payment Depot subscription to access lower fees.

6. Leaders Merchant Services (Clover Reseller): One-Stop Payment Solution

Leaders Merchant Services (LMS) is an integrated payment solution provider that offers a card and contactless reader. Clover hardware resellers provide merchant accounts, which are necessary for businesses that need a card terminal to process payments. Made for business owners to accept credit card payments efficiently. Designed for business owners to efficiently accept credit card payments. With tailored pricing, businesses can choose a card terminal that meets their specific needs. It provides businesses with custom POS setups, including the Clover Go, Clover Mini, and Clover Compact, which are all equipped with a card reader for contactless and chip payments.

Key Features

- Clover Suite Compatibility: Works with Clover Go, Compact, Station, and Mini.

- Flexible Merchant Account Solutions: For business owners looking to accept credit card payments. Offers interchange-plus pricing with customized fees that cater to business owners who accept credit card payments.

- Comprehensive Business Management Tools: Includes inventory tracking, invoicing, and real-time analytics.

- Mobile and Countertop Options: Suitable for both brick-and-mortar stores and field service businesses.

- 24/7 Customer Support: Ensures businesses receive help when needed, especially during critical business days.

Pros

- Versatile Clover hardware with full POS features.

- Potential for customized pricing based on business volume.

- Integrated payment and business management solutions can be enhanced with a built-in card reader.

Cons

- Charges can differ according to business size and credit history, which influences their capacity to accept credit card payments.

- Contract terms may include early termination fees.

7. Stax: Subscription-Based Card Processing Model

Stax (formerly known for its subscription-based model) now offers a Helcim card reader. Fattmerchant is a subscription-based credit card processing service that eliminates percentage-based markups. Instead, businesses pay a flat monthly fee and access wholesale interchange rates, making it ideal for high-volume merchants.

Key Features

- Flat-Rate Subscription Pricing: Offers unlimited transaction processing at a fixed monthly cost.

- Cloud-Based Dashboard: Provides analytics, invoicing, and transaction tracking.

- Customizable POS Integrations: Works with major eCommerce and in-store payment platforms.

- EMV, NFC, and Magstripe Payment Acceptance: Supports all credit and debit card transactions.

- 24/7 Customer Support: Available for merchants with critical payment processing needs.

Pros

- No percentage markups, saving money for high-volume businesses.

- Transparent pricing model with no hidden fees.

- Comprehensive business tools beyond just payment processing.

Cons

- High monthly fees might not be cost-effective for low-volume merchants.

- Requires a merchant account setup, which may take longer than instant-approval aggregators like Square.

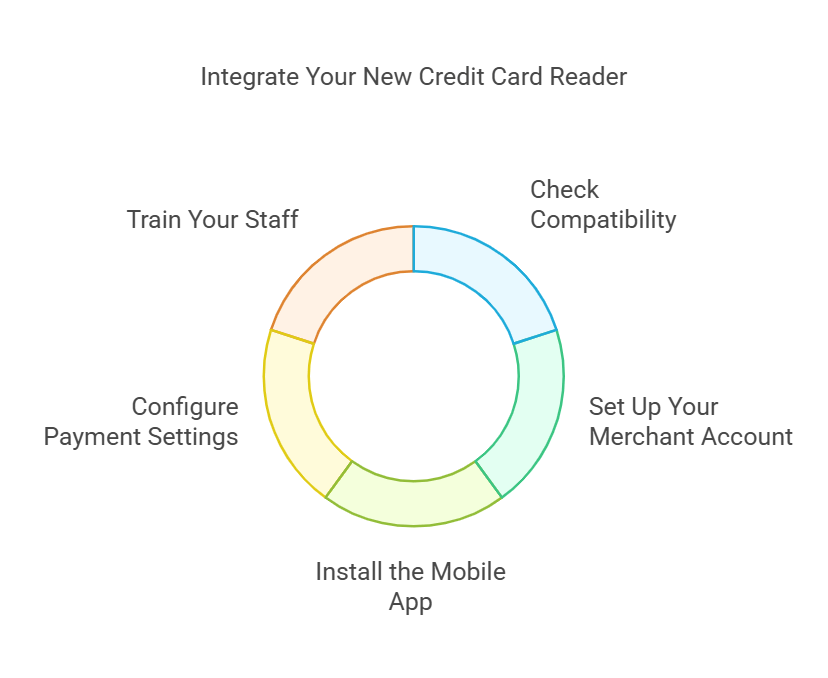

How to Integrate Your New Credit Card Reader Into Your Existing System

Steps for Seamless Integration

- Check Compatibility: Ensure the card reader for your business is compatible with your POS system, accounting software, and mobile devices.

- Set Up Your Merchant Account: If required, create or connect your merchant account to the credit card reader solutions.

- Install the Mobile App: Download the payment provider’s app (e.g., Square point of sale app) on iOS and Android devices.

- Configure Payment Settings: Adjust settings for taxes, tipping, and security preferences.

- Train Your Staff: Educate employees on card reader usage, secure transactions, and troubleshooting common issues.

Comparing Credit Card Readers for Small Business: Quick Reference Table

| Card Reader | Best For | Pricing Model | Key Strength |

| Clover Compact | Small businesses needing a full POS setup | One-time + monthly fees | Customizable with Clover apps |

| Square Terminal | Retail, salons, and small restaurants | Flat-rate transaction | Standalone, built-in printer |

| Toast Go | Restaurants & cafés | Subscription + fees | Tableside payments |

| SwipeSimple B250 | Freelancers, mobile vendors | Pay-per-transaction | Ultra-portable, Bluetooth |

| Dejavoo via Payment Depot | High-volume businesses | Membership-based | Transparent pricing |

| Leaders Merchant Services | Businesses using Clover products | Custom pricing | Full Clover suite integration |

| Stax | High-volume businesses | Monthly subscription | No percentage-based fees |

FAQs About Credit Card Processing & Card Reader Solutions

1. What is the best credit card reader for a small business?

The best credit card reader for small businesses depends on your needs. If you require an all-in-one solution, Square Terminal or Clover Compact is ideal. For restaurants, Toast Go offers tableside payments. If low transaction fees matter, Stax or Dejavoo via Payment Depot provides wholesale pricing. Mobile businesses may benefit from using a SumUp Plus card reader for seamless transactions. SwipeSimple B250 due to its Bluetooth connectivity.

2. What are the different types of credit card readers?

There are four main types of credit card readers:

- Mobile Card Readers: Connect via Bluetooth to smartphones/tablets and can be used with a card reader to accept card payments. (e.g., SwipeSimple B250, Clover Go).

- Countertop Terminals: Fixed-position devices with built-in receipt printers (e.g., Square Terminal, Clover Compact).

- All-in-One POS Systems: Feature-rich setups that manage transactions, inventory, and customer engagement (e.g., Clover Compact, Leaders Merchant Services).

- Smart Terminals: Advanced, cloud-connected devices with touchscreen interfaces (e.g., Toast Go, Dejavoo Terminals).

3. How do credit card readers process transactions?

When a customer inserts, taps, or swipes their credit or debit card, as well as credit card payments, the reader encrypts the credit card information and sends it to the payment processor. The card networks (Visa, Mastercard, etc.) verify the credit card numbers, approve the transaction, and transfer funds to the merchant’s account.

4. How much does a credit card reader cost?

- Free Credit Card Readers: Some companies, like Square, offer a free Square reader, which is a great option for businesses looking to accept card payments without upfront costs. For new sign-ups.

- Basic Mobile Readers: Range from $19 to $99 (e.g., SwipeSimple B250, PayPal Zettle).

- Advanced Smart Terminals: Cost $299 to $799+ (e.g., Square Terminal, Clover Compact).

- Subscription-Based Processing (Stax): Starts at $99/month but eliminates percentage-based fees.

5. What are credit card processing fees?

Credit card processing fees typically include:

- Interchange Fees: Charged by Visa, Mastercard, Amex, and Discover, usually 1.5% – 3.5% per transaction.

- Merchant Processing Fees: Understanding these fees is crucial when using a Square reader for magstripe payments. Payment providers add a markup, varying from a flat rate (2.6% + 10¢) to custom pricing (interchange-plus or membership-based pricing like Stax and Dejavoo).

- Additional Fees: Some providers charge monthly fees, PCI compliance fees, or chargeback fees.

Conclusion: Elevate Your Small Business With the Best Credit Card Reader

Choosing the best credit card reader for a small business is essential for ensuring smooth, secure, and efficient payment processing. Whether you need a mobile solution, a countertop terminal, or an all-in-one POS system, there are numerous options tailored to different business needs.

- If you’re a retail store or service provider, Square Terminal or Clover Compact offers seamless transactions with robust features.

- Restaurants and cafés will benefit from Toast Go, which enhances tableside payment efficiency.

- Freelancers, mobile vendors, and small pop-up businesses should consider SwipeSimple B250 for its Bluetooth connectivity and low-cost entry.

- For businesses that prioritize lower processing fees, Dejavoo via Payment Depot and Stax offers wholesale interchange pricing models with no percentage-based markups.