Contents

- 1 Introduction: AI & ML in the Payment Industry

- 2 How AI & ML Are Transforming Payment Security

- 3 AI in Personalizing Payment Experiences

- 4 Use Cases of AI in the Payment Industry

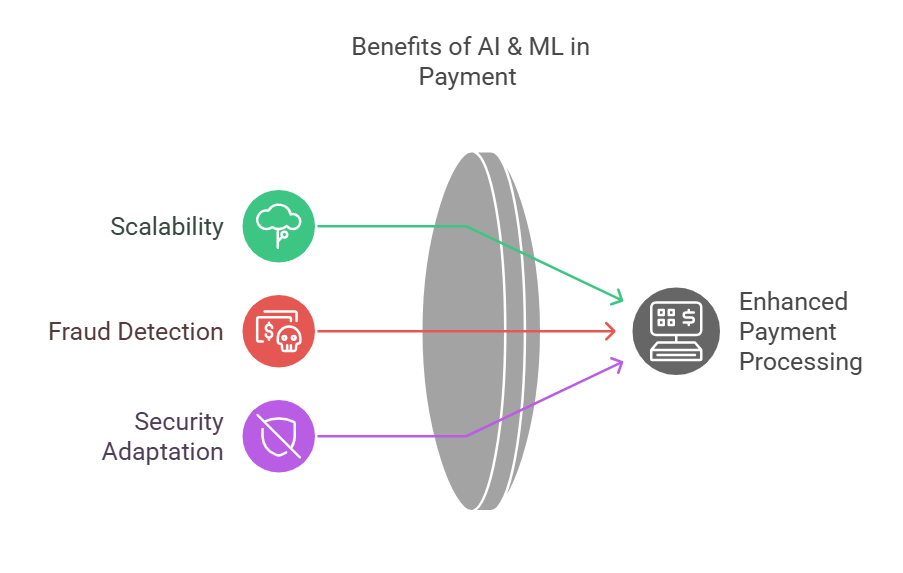

- 5 Benefits of AI & ML in Payments

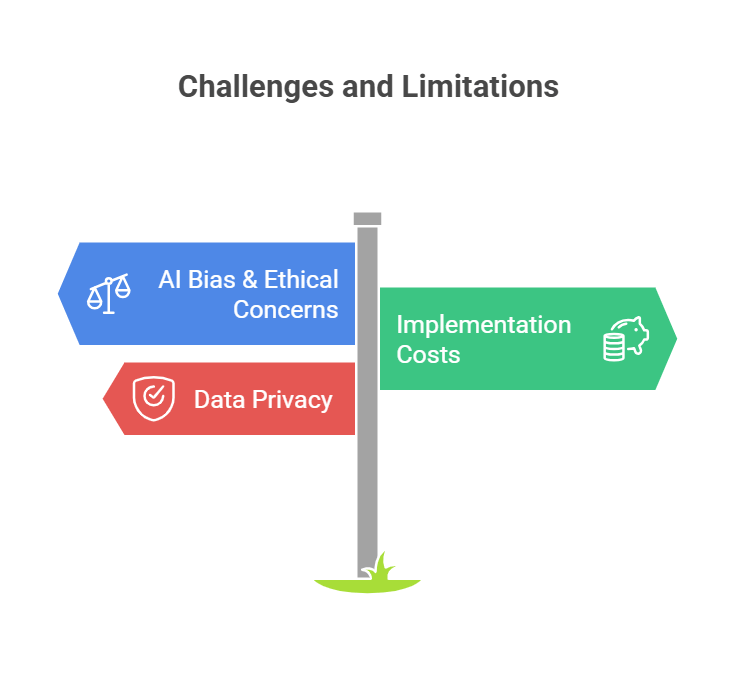

- 6 Challenges and Limitations of AI in Payments

- 7 The Future of AI & ML in Payment Processing

- 8 Conclusion: The Future of AI & ML in Payments

Introduction: AI & ML in the Payment Industry

The world’s financial ecosystem is in the process of a substantial overhaul, propelled by the technological revolution in artificial intelligence (AI) and machine learning (ML). These technologies are transforming the payments sector, reformulating fraud protection strategies, and improving customized payment experiences. While digital payments take center stage, the demand for strong security processes and smooth transactions has never been greater.

The Rise of Digital Payments and Fraud Concerns

The surge in e-commerce, mobile transactions, and contactless payments has introduced unparalleled convenience for consumers. However, this digital revolution has also led to a surge in fraudulent activities, making payment fraud detection more critical than ever, particularly in the context of large amounts of data. According to a recent report, global online payment fraud losses are projected to reach $48 billion annually by 2025, underscoring the urgent need for advanced fraud prevention mechanisms. Traditional security measures, such as static rule-based systems, are proving inadequate in combating sophisticated cyber threats. This is where AI and ML step in, offering dynamic, real-time fraud detection capabilities, which are essential in analyzing large amounts of data.

How AI & ML Are Addressing Payment Security Challenges

AI and ML leverage massive datasets, analyzing transaction patterns, user behaviors, and anomaly detection to identify fraudulent activities in real-time. Unlike traditional fraud detection methods that rely on predefined rules, ML-powered solutions adapt and evolve, continuously improving their accuracy. Payment service providers, banks, and fintech companies are increasingly incorporating AI-driven security measures to mitigate risks while ensuring a smooth user experience.

The Importance of Personalization in Payments

Beyond security, AI and ML are revolutionizing the personalization of payment experiences. Consumers expect frictionless, tailored payment options that align with their behaviors and preferences. From smart payment suggestions driven by AI to auto-processing invoices, companies with AI-powered payment systems are competitive through improved customer satisfaction and loyalty.

With AI and ML leading the way, payments in the future will not only be safer but also more efficient and consumer-friendly, opening the doors to new-age real-time payments. This article explores the revolutionary effect of AI on payment security, its function in fraud detection, and the many advantages it offers to consumers and businesses alike.

How AI & ML Are Transforming Payment Security

AI-Powered Fraud Detection & Prevention

Financial institutions are increasingly adopting AI and ML to combat fraud, recognizing that AI is transforming fraud detection and prevention strategies. In 2024, 71% of these institutions utilized AI and ML for fraud detection, up from 66% in 2023.

These technologies analyze vast transaction datasets to identify patterns indicative of fraudulent activities, effectively countering threats like card-not-present (CNP) fraud, identity theft, and chargeback fraud.

Real-Time Fraud Detection with ML Algorithms

Machine learning models are best for real-time payment analysis of payment transactions, immediately identifying anomalies and minimizing the chance of human mistakes. Large payment processors like Visa and Mastercard have incorporated AI to support instant fraud detection ability, making international payments safer and showing the application of AI for financial transactions. Visa, for example, has implemented more than 500 AI applications to reinforce security and business efficiency.

Reducing False Positives with AI

Traditional fraud detection systems often flag legitimate transactions as fraudulent, leading to customer dissatisfaction. AI mitigates this issue by employing behavioral analysis to distinguish between genuine and suspicious activities, thereby reducing false positives and enhancing the user experience through advanced AI models.

Machine Learning for Risk Scoring

AI provides dynamic risk scores for transactions based on user behavior and history, highlighting the use of AI in detecting fraud. PayPal, for instance, uses AI-based fraud scoring to evaluate transaction risk in real time, improving security protocols.

AI in Personalizing Payment Experiences

AI-Driven Smart Payment Recommendations

AI analyzes customer behavior to offer personalized payment solutions. E-commerce platforms like Amazon employ AI-driven one-click payment systems, streamlining the purchasing process and enhancing user satisfaction, showcasing the application of AI in improving payment experiences.

Chatbots & AI Assistants Enhancing Customer Support

AI chatbots effectively handle payment-related queries, offering real-time assistance and enhancing customer service using natural language processing, which is an essential feature of AI solutions and reflects the use of AI in customer engagement. AI also strengthens Know Your Customer (KYC) operations by automating identity checks, lowering onboarding time, and enhancing accuracy.

Automating Invoice and Payment Processing

AI makes automatic invoice handling and payment processing, minimizing errors and speeding up the time it takes to transact. For SaaS firms, AI systems automate billing procedures, resulting in enhanced cash flow and business efficiency.

Use Cases of AI in the Payment Industry

Fintech Companies Leveraging AI for Secure Payments

Fintech startups lead the way in embracing AI to fight fraud and protect payments. Firms such as Stripe and Square use machine learning algorithms to watch over transactions and detect probable fraud in real time, ensuring secure payment transactions for users.

How Major Payment Gateways Are Using AI

Leading payment gateways, including PayPal, Visa, and Mastercard, have integrated AI into their systems to enhance security and efficiency, demonstrating how AI is transforming the payments industry. Visa, for instance, has implemented over 500 AI use cases, focusing on fraud detection and operational optimization.

Regulatory Compliance and AI in Payments

AI helps businesses maintain compliance with financial regulations through the automation of processes. AI-enabled fraud detection is central to anti-money laundering (AML) campaigns, ensuring the legitimacy of transactions as per lawful requirements and curbing the probability of regulatory penalties. They can also catch fraud efficiently.

Benefits of AI & ML in Payments

Enhanced Security & Fraud Prevention

- AI analyzes vast amounts of transactional data to detect fraudulent patterns instantly.

- Machine learning algorithms identify anomalies and alert security teams to prevent cyber threats, significantly improving payment fraud detection measures.

- AI reduces false positives, ensuring legitimate transactions are not blocked.

- Real-time fraud detection minimizes financial losses for businesses and consumers, showcasing the power of AI in transforming payment security.

Improved Customer Experience & Personalization

- AI-driven payment recommendations enhance user convenience by suggesting preferred payment methods and utilizing AI tools for more personalized suggestions.

- AI chatbots assist customers with payment-related queries, reducing response times and utilizing natural language to enhance communication.

- Adaptive authentication improves security without compromising user experience.

- AI streamlines Know Your Customer (KYC) processes, making onboarding faster and more efficient.

Operational Efficiency & Cost Reduction

- Automated payment processing reduces manual intervention, minimizing errors and enhancing the overall power of fraud detection systems.

- AI-powered risk assessment helps financial institutions optimize credit approvals.

- AI enhances invoice management, reducing processing time and operational costs.

- Businesses save resources by automating compliance and fraud monitoring processes and utilizing machine learning techniques for better efficiency.

Regulatory Compliance & Data Protection

- AI assists in ensuring compliance with data protection regulations such as GDPR, reducing human error in data management.

- AI-powered fraud detection tools support Anti-Money Laundering (AML) efforts and illustrate the application of AI in compliance.

- Machine learning models detect suspicious transactions, helping financial institutions avoid penalties and demonstrating use cases for AI in the finance sector.

Scalability & Adaptability

- AI-driven payment solutions can scale with business growth and handle increasing transaction volumes.

- Machine learning models continuously evolve, improving fraud detection accuracy over time and addressing the challenges presented by large amounts of data.

- AI-powered payment gateways adapt to new threats, ensuring ongoing security and demonstrating use cases for AI in payment processing.

Challenges and Limitations of AI in Payments

AI Bias & Ethical Concerns

AI systems can unintentionally replicate biases that exist in the data used for training them, which creates ethical issues in fraud detection and customer relations, especially with payment data. Maintaining fairness and transparency in AI algorithms is crucial in upholding trust and compliance, particularly as more businesses are making AI models integral to their operations.

High Implementation Costs

Its integration demands a considerable investment in human capital, infrastructure, and ongoing upkeep to optimally utilize machine learning for the detection of fraud. Small and medium-sized businesses could find such investment expensive, making it a disincentive for adoption.

Regulatory and Data Privacy Challenges

Navigating the complex landscape of data privacy regulations, such as GDPR, presents challenges for AI implementation in payment systems, especially in the context of real-time payments. Businesses must ensure that their AI solutions comply with data protection laws to avoid legal repercussions, particularly when using machine learning tools for payment fraud detection.

The Future of AI & ML in Payment Processing

The payment industry is poised for continued transformation through AI and ML advancements. Emerging trends include the integration of generative AI for enhanced fraud detection and the convergence of AI with blockchain technology to create more secure and transparent payment ecosystems. As AI continues to evolve, its role in payment processing will expand, offering innovative solutions to emerging challenges and demonstrating that AI has the potential to revolutionize the industry.

Conclusion: The Future of AI & ML in Payments

AI and ML have proven to be game-changers in the payment industry, driving enhanced security, operational efficiency, and user-centric experiences, particularly in global payments. As cyber threats grow more sophisticated, businesses must stay ahead by adopting AI-powered fraud prevention strategies that utilize real-time payments to mitigate risks. The ability of machine learning models to continuously learn and adapt makes them invaluable in tackling financial crimes in real-time, especially when utilizing new data for fraud detection.

Aside from fighting fraud, AI contributes to the personalization of payment by establishing a seamless ecosystem for customers and businesses. In the presence of open banking, digital wallets, and touchless payments, AI-powered technology is redefining financial solutions. Businesses not integrating AI would find themselves trailing in a cutthroat marketplace whose success is predetermined by security and customer experience.

Forward-looking, the integration of AI, ML, and blockchain technology has the potential for even more transparent and secure payment solutions. Companies need to accept AI as a vital investment that will keep their payment infrastructure safe from new threats while using new data to make better fraud prevention and detection possible. As payment processors, fintech innovators, and financial institutions continue to develop AI uses, the future of payments will be safer, faster, and smarter than ever.

The adoption of AI in payments is no longer a luxury but a necessity. Those who leverage its full potential will not only enhance fraud detection and streamline operations but also build trust with their customers in an increasingly digital world.