Finding one’s place in the modern marketplace for BNPL is like trying to navigate the labyrinth of innovation and uncertainty. Corporations all over the world are now investing in “pay later” models that are convenient but also risky. In this payment ecosystem, a newly emerging solution known as a pay later service reshapes how consumers and merchants engage with every payment method available. Ready to use buy now, pay later? Let’s peel back the layers of BNPL’s growth, fall, and future possibilities.

Contents

- 1 Introduction to Buy Now, Pay Later (BNPL) Payment Method

- 2 The Growth of BNPL: From Trend to Mainstream Payment Solution

- 3 BNPL’s Highs and Lows: Challenges and Opportunities

- 4 The Fall of BNPL: Market Saturation and Regulatory Hurdles

- 5 How BNPL Affects Your Payment Method

- 6 Best Practices for SaaS Payment Gateways to Navigate BNPL

- 7 Conclusion

Introduction to Buy Now, Pay Later (BNPL) Payment Method

BNPL, short for “buy now pay later” has taken center stage in modern finance, allowing consumers to split a payment into smaller portions instead of handling the full Payment upfront. This innovative approach can include an installment loan process in which individuals pay off their purchases in scheduled increments. The impact on retailers and SaaS providers alike can be substantial. For decision-makers, it’s vital to recognize how BNPL differs from using a credit card or borrowing from a traditional lender and how it might eventually affect your credit score.

Understanding the BNPL Boom

BNPL’s surge in popularity is partly driven by fintech platforms, particularly BNPL app solutions, and partly by growing consumer preference for flexible payment models. Recent studies show that BNPL accounts for a noteworthy slice of digital commerce, rivaling the use of traditional credit cards in some regions.

Technicali Action Step: Watch for increasing adoption of BNPL among younger demographics, who often shy away from hefty credit card debt. Also, keep an eye on bnpl companies that may emerge rapidly, introducing new features like zero-interest bnpl plan options.

The Growth of BNPL: From Trend to Mainstream Payment Solution

BNPL’s meteoric growth can be traced back to a trend fueled by convenience-hungry consumers. Suddenly, shoppers could pay for items in installments rather than swiping a credit card for the entire sum. The allure of minimal or no interest charges, plus a frictionless checkout, helped BNPL shift from a niche concept to a core payment method that many e-commerce merchants now offer.

How BNPL Became a Pay Later Service

Early bnpl providers such as Affirm, Afterpay, and Klarna integrated seamlessly with countless online stores, thus rewriting how consumers buy. Their gateway strategies effectively turned a simple credit check into a quick, near-instant approval process. Although the convenience is appealing, a challenge often lurks behind the scenes: balancing frictionless shopping with risk management. Still, the opportunity for online sellers was substantial.

Key BNPL Companies Driving Innovation

- Many BNPL players, such as Affirm, Klarna, Sezzle, and others, lead the market.

- These brands offer a distinct BNPL service, often presenting variable payment plans, such as biweekly payments or a single monthly payment.

- BNPL users frequently choose installments over a credit card, attracted by simpler sign-up processes and, sometimes, no interest fees.

BNPL Adoption Across Different Markets

BNPL’s universal appeal stretches well beyond clothing and electronics. SaaS providers, subscription services, and even B2B enterprises now dabble in these pay-later methods to drive conversions. The Consumer Financial Protection Bureau has taken note, signaling a need for regulation that could shape BNPL’s trajectory in digital commerce.

BNPL’s Highs and Lows: Challenges and Opportunities

BNPL’s universal appeal stretches well beyond clothing and electronics. Service providers must know if they are consistently getting timely payments to avoid defaults. Furthermore, the convenience that entices shoppers to buy can also lead to overspending.

Common Pain Points and Security Concerns

- Fraudulent activity: When shoppers pay with BNPL, verifying identities becomes crucial to avoid fraudulent purchases.

- Lack of credit building: Unlike some credit card companies, BNPL firms might not always send payments to the credit bureaus, which can stunt credit-building potential.

- Late fee dilemma: BNPL providers frequently charge interest or additional fees for late or missed repayment.

BNPL May Affect Your Credit Score

BNPL usage can vary from a soft credit check to a hard credit check, depending on the provider. Sometimes, if you miss a payment or carry multiple BNPL balances, you might face a low credit score. The concern is that BNPL can inadvertently hurt your credit score, especially if you accrue debt beyond your means.

BNPL Loan Repayment and Late Fee Issues

A BNPL loan typically involves structured repayment terms weekly, monthly, or biweekly payments. Missing a payment due date might lead providers to charge late fees, and such tardiness can be reported to the credit bureaus. A Payment Gateway SaaS integrating BNPL responsibly can stand out by protecting users from spiraling debt and clarifying any late payment ramifications.

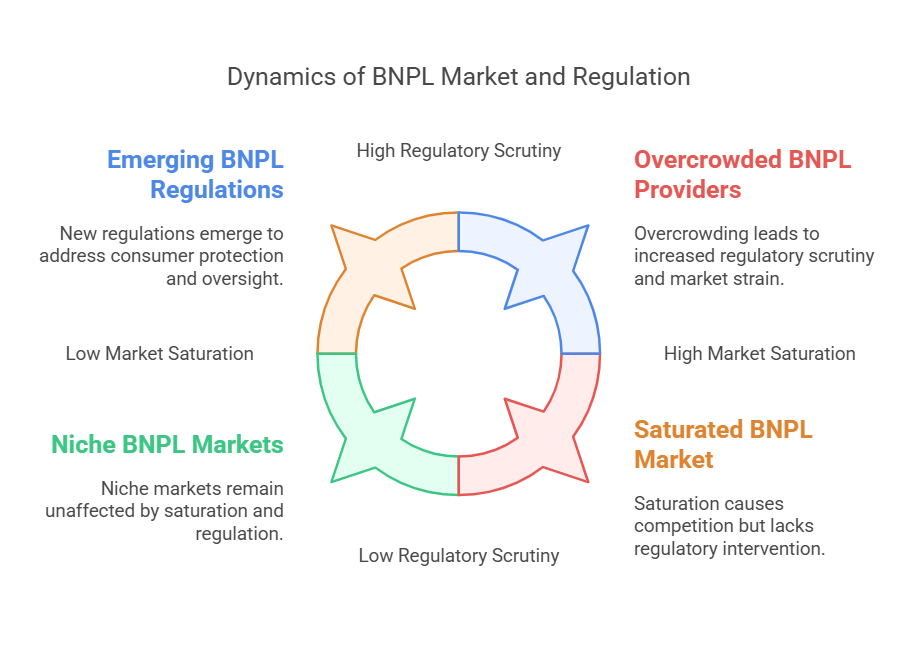

The Fall of BNPL: Market Saturation and Regulatory Hurdles

Undeniably, there is much enthusiasm around BNPL, but oversaturation and tighter scrutiny spell a potential fall. Overcrowding of BNPL providers in the market may cause a strain on the BNPL payment solutions market and force providers to revise their strategies.

Why BNPL Loans Don’t Always Help Consumers

Not all BNPL loans don’t lighten the load for shoppers. Overlapping BNPL plans can quickly feel like a credit card problem, especially if multiple installments stack up. Some providers may charge hidden fees or intensify user confusion with expansions of each BNP plan. This can spiral into unmanageable credit card debt for those lacking a clear repayment strategy.

The Role of Regulation

Agencies like the Consumer Financial Protection Bureau have begun examining BNPL practices to protect consumers from surprise fees and irresponsible lending. If BNPL evolves to become more like a credit card in terms of regulation, providers will face stricter guidelines, including thorough disclosures, robust credit reporting, and possibly BNPL’s rest caps.

BNPL’s Impact on Payment Gateways

For Payment Gateway SaaS, there’s a challenge in continuously refining security protocols and credit reporting processes for BNPL integrations. If fees climb or oversight tightens, businesses might see BNPL usage decline. Balancing user convenience and money and pay transparency is thus critical.

How BNPL Affects Your Payment Method

Whether it is an e-commerce venture or a multinational SaaS venture, BNPL can change its approach to payment systems. Whether to go for BNPL or conventional modes of payment requires an unbiased estimate of the advantages and disadvantages that come along with it.

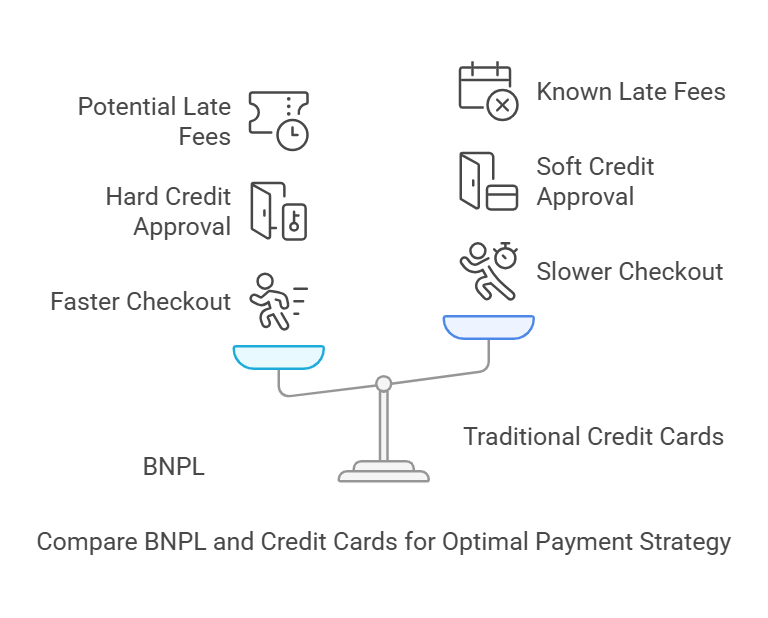

Evaluating BNPL vs. Traditional Credit Cards

Pros: Faster checkout, minimal friction, and the potential for larger basket sizes compared to a standard credit card.

Cons: Some BNPL setups require hard credit approval, and users risk incurring a late fee if they don’t pay diligently.

Technicali Action Step: Draft a quick chart comparing BNPL interest, fees, and ease of approval against a credit card. This helps you see whether your audience is better served by BNPL or conventional borrowing.

Creating a Secure BNPL offering

- Check your credit systems: Decide whether you’ll do a soft credit check or a hard credit check.

- Collaboration: Align with a reliable bnpl lender or bnpl companies that champion user-centric values.

- By doing so, your product (or pay later loans) could become a safer alternative for those who want to pay and finance their purchases responsibly.

Future of BNPL: New Trends and Emerging Solutions

Some BNPL models incorporate a debit card direct card or bank account transaction rather than deferring the entire sum. Consumers increasingly prefer systems that track payment history and payments over time more closely so that payments can be simpler. As user demands shift, expect providers to experiment with new structures and highlight how to use the credit responsibly.

Navigating BNPL responsibly can position a Payment Gateway for heightened trust and ongoing growth. This can directly impact your credit integration workflows if you aim to keep user data pristine and reduce default risks.

Integrating BNPL Responsibly

- Offer disclaimers around installment details and repayment schedules, especially if you let shoppers pay for them over time.

- Encourage payments on time with timely alerts, preventing users from incurring a late payment.

- Employ advanced fraud controls to prevent fraudulent activity and verify user identity swiftly.

Communicating Security and Trust

Reinforce to customers that your product can handle quick BNPL approvals without sacrificing privacy. Point out how your model builds security. For example, you only use a hard credit check in very few cases and have a light, easy-to-obtain soft credit check otherwise. This policy earns confidence and resonates well with the paranoid overspenders.

Conclusion

Preparing for the Next BNPL Waveit’s BNPL phenomenon is more than a passing fad; it’s an evolving ecosystem of risk, reward, and relentless innovation. From exploring how certain BNPL expansions meet regulatory friction to highlighting installment loan nuances, BNPL continues to mold future payment landscapes.

Key Takeaway: If integrated with caution, BNPL can drive sales and offer a unique edge to your business. Should it be mishandled, though, it might hurt your credit score or foster detrimental credit habits.

Bonus Insight: Learn How BNPL Works in Real-Time

If you’re eager to learn how bnpl works, consider a pilot program or a sandbox environment in your Payment Gateway. Rack metrics such as default rates, loan payment success, and first payment compliance. The data can help you refine your BNPL offering and ensure your customers can pay back borrowed amounts without undue stress.

Thousands appeal can help shoppers eschew that final swipe on their credit cards; BNPL means businesses get clear communication regarding transparent fees, well-informed use of risk analysis, then safe revenue generation in reputation maintenanBNPL’such deep analysis of the growth and decline of BNPL makes it really important to hear the voice of the consumer needs and regulatory changed BPNL loans don’t always result in beneficial outcomes. By aligning your Payment Gateway SaaS, you’ll pay dividends in trust, security, and ongoing loyalty.