Have you ever paused to consider how blockchain might transform the way payment systems operate? Or perhaps you’re intrigued by the prospect of blockchain payment solutions that enable lightning-fast crypto settlements, secure data storage, and unparalleled transparency. As blockchain technology continues to mature, payment processing stands on the brink of disruption; here’s why we use blockchain for critical services such as ACH trade finance. We encourage users to buy in more seamless, efficient ways.

Contents

- 1 1. Introduction to Blockchain in Payment Gateways

- 2 2. How Blockchain Payment Works in Practice

- 3 3. Why Leading Payment Provider Solutions Embrace Blockchain Technology

- 4 4. Core Benefits of Blockchain Technology for International Payment Processing

- 5 5. DeFi, Trade Finance, and ACH: Blockchain Use Cases

- 6 6. Driving Blockchain Adoption: Real-World Examples & Key Applications

- 7 7. Conclusion: The Future of Payment Gateways with Blockchain

1. Introduction to Blockchain in Payment Gateways

1.1 Understanding the Revolution in Payment Methods

In 2023, global enterprises are witnessing a revolution in payment methods largely driven by blockchain innovations. According to Juniper Research has found that blockchain deployments will enable banks to realize savings on cross-border settlement transactions of more than $27 billion by the end of 2030, reducing costs by more than 11% per on-chain transaction. Why? Many traditional payment services rely on a central authority, leading to elevated transaction fees, restricted data transparency, and slower turnaround times.

However, blockchain’s capacity to decentralize transaction validation allows businesses to eliminate intermediaries, speeding up processing while helping to reduce costs. By dismantling these centralized choke points, organizations can reallocate resources toward customer service and product development instead of back-end transaction settlement.

1.2 Why Blockchain Support Center Insights Matter

Resources provided by the Blockchain Support Center can guide forward-thinking executives in integrating next-generation technologies so that users can buy digital products or services. This center often addresses queries on crypto payment platforms, furnishing valuable counsel and tools.

Are you seeking blockchain solutions or payment solutions that are both secure and tamper-proof? The Support Center dispenses guidance, ensuring your transition to decentralized technology is smooth. Essentially, blockchains (including private blockchains and blockchain-based systems) rely on a distributed ledger for tracking business transactions in a permissionless and immutable manner. They encrypt each entry, combine public keys with a private key for authentication, and use sophisticated algorithms to cryptographically verify each block.

Key Takeaway

Harnessing distributed ledgers allows transactions to be recorded transparently, ensuring your operations maintain speed and security without compromising integrity.

2. How Blockchain Payment Works in Practice

2.1 The Role of Distributed Ledger Technology

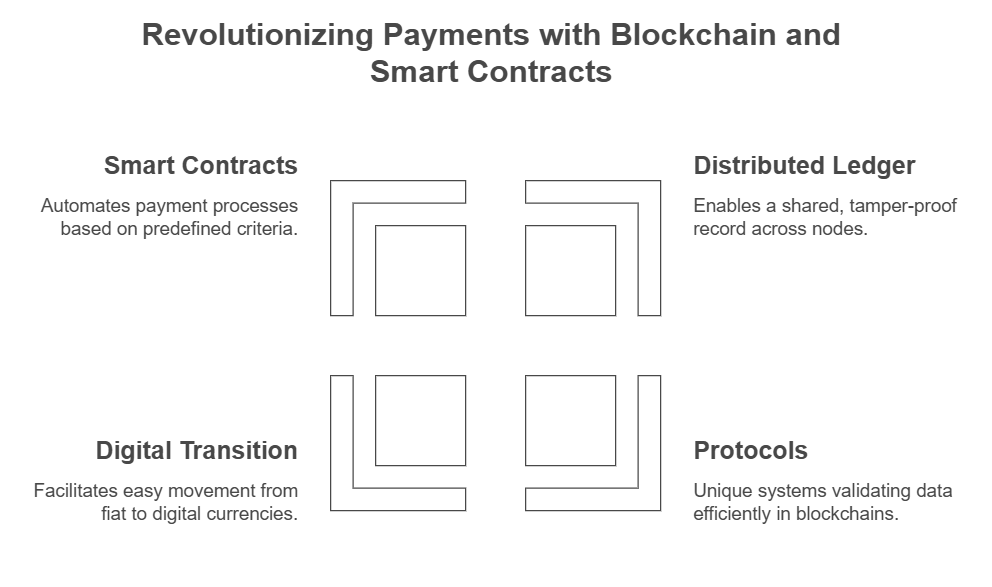

At its core, distributed ledger technology (DLT) powers blockchain payment systems by creating a shared, synchronized ledger accessible to all authorized nodes. This approach eradicates the need for paper-based records or redundant databases. Whenever a new block is formed; after certain conditions are met; the data becomes tamper-proof, sealed by a consensus mechanism that verifies authenticity.

Whether you explore Ethereum, Ripple, or Litecoin, each uses unique protocols to validate data within its blockchain system. Across the board, such protocols reduce operational costs, speed up transactions, and diminish reliance on legacy infrastructure.

2.2 From Fiat to Digital Assets

Transitioning from fiat to digital currency or cryptocurrencies like bitcoin has never been simpler, particularly for cross-border or international payments. With fewer intermediary organizations demanding fees, companies can expedite settlements while paying less. A reliable crypto wallet on platforms like blockchain.com helps users send and receive digital assets at rates that are often more appealing than traditional services.

Additionally, smart contract programs stored on blockchains let you automate payment processing flows. When you embed a smart contract into your billing system, you can trigger instantaneous payouts the moment specified criteria are met, whether it’s for recurring invoices or performance-based commissions.

Example Use Case

A B2B SaaS provider could automate monthly subscriptions using blockchain-based smart contract triggers. This method cuts administrative overhead and supports real-time domestic and cross-border payments without the friction accompanying conventional invoicing.

3. Why Leading Payment Provider Solutions Embrace Blockchain Technology

3.1 Accelerating Transactions and Enabling New Revenue

More and more blockchains are emerging to enable new features – this is leading to expanded payment solutions for every payment provider aiming to stand out in a crowded market. Indeed, Mastercard’s pilot programs highlight how blockchain can open up new revenue streams by reaching untapped segments and delivering faster, more efficient settlements.

Beyond speed, blockchain payment processing can facilitate near-immediate clearance for international transactions. By supporting multiple local currency options, you can execute payments around the globe and reduce costs across the transaction cycle.

3.2 Security and Immutability

Adopting private and public blockchains ensures secure, decentralized data handling. Each block’s immutability means any record, once placed on the chain, cannot be altered without broad network consensus. For financial institutions, this robust design significantly lowers fraud risks as transactions become practically incorruptible on a distributed ledger.

3.3 Supporting Real-Time Domestic and Cross-Border Payments

In regions where supporting real-time domestic and cross-border transactions is crucial, international payment processing through blockchain offers powerful advantages. Cross-border payments at lower rates reduce frustration for businesses, which no longer require complicated routing networks that add layers of complexity and cost; much like banks historically have done.

Industry Fact

The majority of global financial services companies plan to increase FinTech partnerships as 88% express concern they will lose revenue to innovators, according to a new PwC global report. This effectively enables blockchains and helps them decentralize clearinghouses and modernize ACH settlements.

4. Core Benefits of Blockchain Technology for International Payment Processing

4.1 Key Advantages and Data Transparency

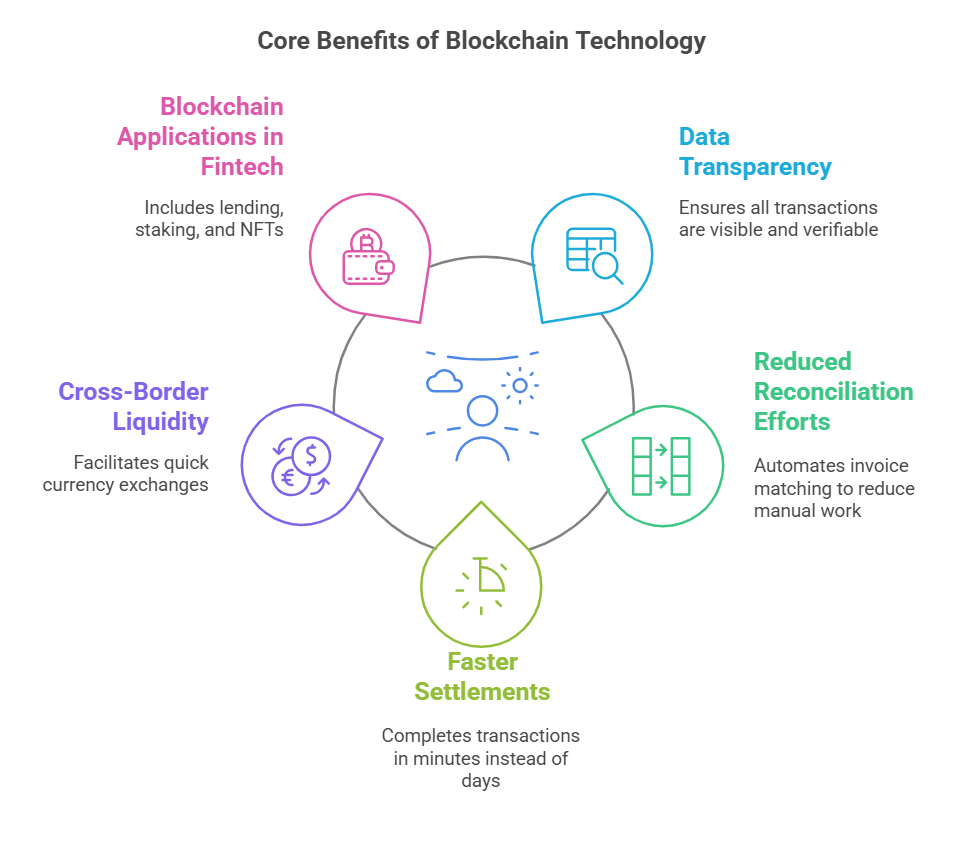

Among the many benefits of blockchain technology, a few stand out for international operations:

- Data transparency: A shared ledger makes it impossible to conceal illicit transactions or hidden fees.

- Reduced manual reconciliation: By hosting programs stored on-chain, companies can systematically automate invoice matching and reduce staff overhead.

- Compared to traditional services, international settlements close within minutes or hours instead of days, therefore saving enormous sums of money for traditional services.

4.2 Facilitating Cross-Border Liquidity

When dealing with foreign currencies, liquidity management is paramount. Blockchains allow near-immediate exchanges of digital assets, eliminating stiff exchange-rate markups. Meanwhile, within trade finance, the ability to use blockchain to verify large shipments or contracts avoids cumbersome documentation.

4.3 Examples of Blockchain Applications in Fintech

In the bustling realm of defi (decentralized finance), you’ll find blockchain applications like lending, staking, and yield farming – recently valued in billions of dollars. Even NFTs are an intriguing use case that extends blockchain technology beyond payment alone, capitalizing on tokenized assets and building robust secondary marketplaces.

5. DeFi, Trade Finance, and ACH: Blockchain Use Cases

5.1 DeFi in Trade Finance

DeFi platforms optimize trade finance by eliminating reliance on an intermediary, substituting automated escrow with self-executing smart contract conditions that finalize payment only when conditions are met. This approach addresses fraud by ensuring each transaction is validated and recorded on-chain.

5.2 ACH and Real-Time Domestic Payments

Imagine your payroll being issued through a blockchain adoption pipeline that confirms wages in near real-time. This is gradually becoming the norm. By merging ACH with decentralized validation, your company can slash overhead and accelerate settlement times, removing the need to eliminate intermediaries at every step of business transactions.

5.3 International Payment Processing with Blockchain Payment Processing

When it comes to international payment processing, using blockchain payment processing yields multiple advantages: streamlined conversions, minimal transaction fees, and zero reliance on inefficient banking corridors. Payment methods like Bitcoin, lite coin, or ripple function as bridging assets for swift international payments, effectively bypassing the labyrinth that plagues legacy wires or money transfers.

6. Driving Blockchain Adoption: Real-World Examples & Key Applications

6.1 Applications, Use Cases, and Blockchain Consortiums

Although the widespread application of blockchain solutions in global trade is yet available at scale, the momentum is undeniable. A blockchain consortium; formed by tech giants, financial institutions, and regulatory bodies – offers guidelines and best practices to ensure trust.

6.2 How Technology Continues to Evolve

Technology continues to move forward, bridging corporate finance with NFTs, tokenized real estate, and users using digital wallets for day-to-day purchases. In some advanced ecosystems, transactions can take mere seconds. That’s especially relevant in u.s markets where quick settlement can benefit businesses that rely on fluid cash flow.

6.3 Overcoming Common Objections

Those wary of costs or complexity might fear radical transformation. However, manual reconciliation can be replaced with distributed ledger technology that autonomously logs each transaction. Even with budget constraints, you can test a single use case to confirm the viability of a broader strategy. Over time, comprehensive blockchain adoption can be phased in gradually, enabling methodical scaling.

Pro Tip: Launch a pilot project with a limited scope; perhaps involving only one product line – before fully committing to decentralized architecture.

7. Conclusion: The Future of Payment Gateways with Blockchain

7.1 The Path Forward

As the global marketplace changes, payment gateways and payment provider solutions will keep evolving. Businesses seeking to stay competitive might adopt blockchain for secure, tamper-proof settlements. By integrating decentralized rails, you can enable new forms of value exchange, embracing real-time domestic and cross-border payments that execute payments more efficiently than ever.

7.2 Key Takeaways

- Revolutionize your SaaS by deploying blockchain technology where it best fits your workflow.

- Reduce costs through higher-speed payment processing enabled by distributed ledger technology.

- Use smart contract automation to automate pivotal business transactions with minimal human intervention.

- Expand your consumer base by offering secure channels bridging fiat and cryptocurrency, thereby fostering trust in a rapidly shifting digital market.

Don’t wait: Checkout top blockchain payment solutions today. Early blockchain adopters secure a formidable advantage, unlocking new revenue channels and delivering dynamic payment methods to clients worldwide.